Navigating the complex world of health insurance for employees can feel like finding a needle in a haystack — overwhelming and often confusing.

As a leader in company culture, you know that excellent benefits are not just perks but strategic business tools that can make or break staff satisfaction.

With this guide, we aim to demystify the process of finding the ideal health insurance benefits for employees, breaking down what really matters to your organization and introducing tools that simplify your decision-making process. In other words, we’re offering you “healthy” advice!

Are you looking for the right insurance coverage for your company?Jump to the right section to learn more: |

Why Employee Health Insurance Matters More Than Ever

In an era where your workers’ well-being is paramount, health insurance is a necessary component of any successful business strategy.

With comprehensive coverage included, you offer distinct benefits that could enhance your organization’s overall performance. Some core business advantages of providing health insurance are:

- Attracting and retaining top talent: Today’s job market is competitive, so offering robust health insurance benefits is key to setting yourself apart and drawing in the best candidates.

- Boosting productivity and reducing absenteeism: A healthy workforce is a present and productive workforce. Offering packages that encourage preventive care and provide easy access to medical services helps your team remain productive by minimizing sick days and creating a healthy workplace environment.

- Improving morale and company culture: Quality team health coverage demonstrates a value for your team’s well-being that reaches beyond their in-office contributions. Your proactive actions can foster loyalty, cultivating a positive culture where people feel valued and appreciated.

- Promoting financial advantages for the business: Investing in health insurance can lead to potential tax benefits, with defined contributions helping predict and manage costs effectively. Strategically, your bottom line and your employees benefit, creating a win-win scenario.

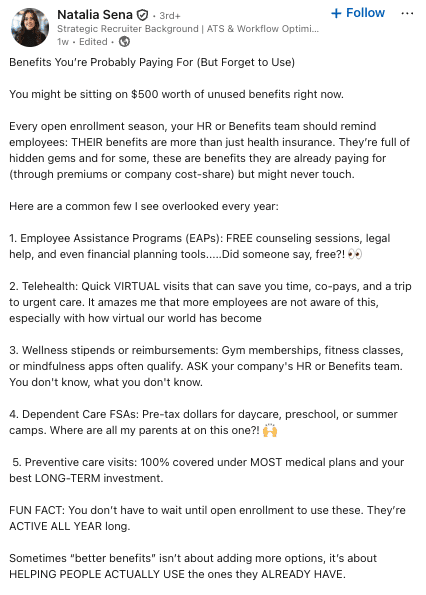

Pro-Tip: Office manager, Natalia Sena shared this super helpful benefits breakdown to help employees maximize the impact of their health insurance program.

Understanding Different Health Insurance Options

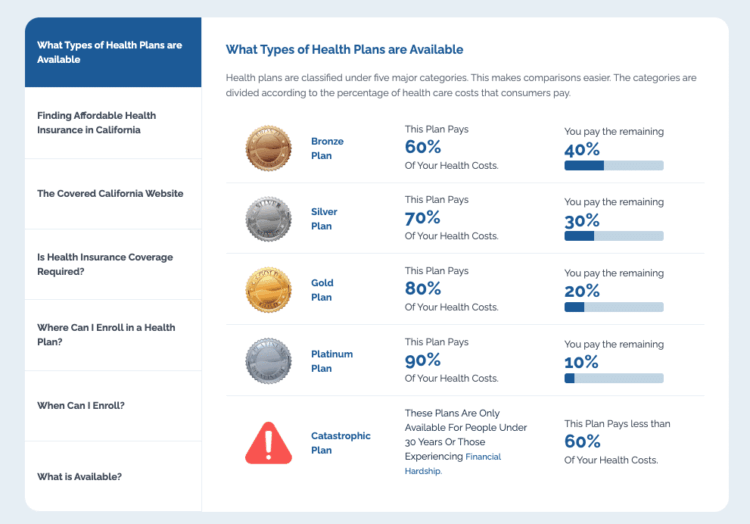

When selecting health insurance for your workplace, it helps to understand the various types of plans available. Each offers different levels of flexibility and cost, allowing you to assess the best option for your business, staff and budget. Here’s a brief overview of the main types of health insurance plans.

Health Maintenance Organization

Health maintenance organization (HMO) plans require you to select a primary care physician for your team and obtain referrals to see specialists. These typically have lower premiums and out-of-pocket costs, but they offer less flexibility in choosing providers, with their services limited to specific networks.

Preferred Provider Organization

Preferred provider organization (PPO) plans are more flexible than HMOs, allowing your teams to see doctors or specialists of their choosing without referrals.

Premiums are generally higher than HMO plans, with the trade-off being greater choice and convenience. Your team members will find health care access easier, but a PPO will likely cost you more.

Exclusive Provider Organization

Exclusive provider organization plans are similar to PPOs in many ways but do not cover out-of-network care except in emergencies. They provide a balance between cost and flexibility, offering lower premiums than PPOs and allowing people to see specialists without prior referrals.

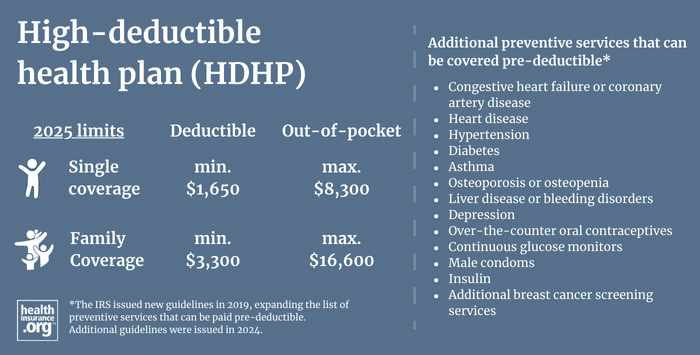

High Deductible Health Plan

Courtesy of Healthinsurance.org

High deductible health plans involve lower premiums but higher deductibles. You’ll often find them with health savings accounts, which allow workers to save money for medical reasons tax-free. These can be cost-effective for some but may pose financial burdens for those who need frequent medical care.

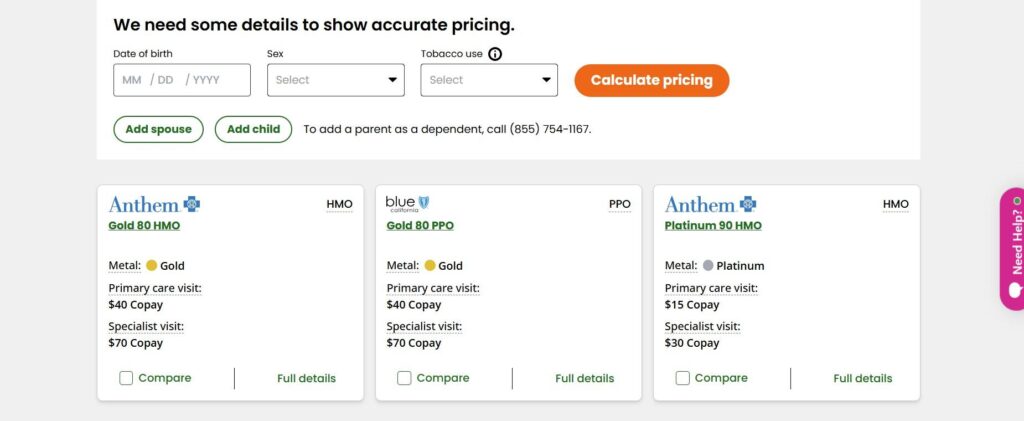

Navigating these different options can be overwhelming, especially when trying to find the best all-around fit for your team. These instances are where marketplaces and exchanges come into play as modern solutions to simplify the process.

Instead of contacting each health insurance carrier individually, you can access a centralized platform that offers a range of options side by side.

With this alternative in mind, several options are available for small businesses.

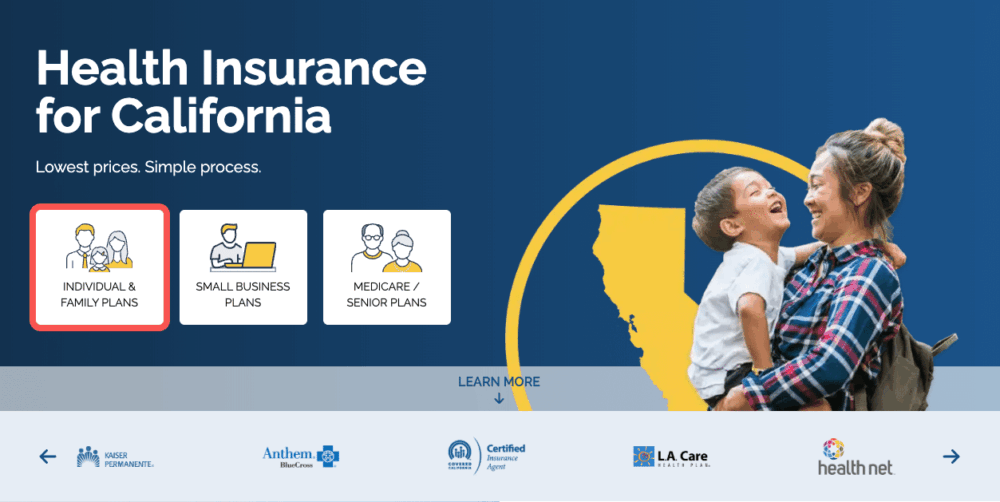

1 Health for California Insurance Center

Health for California (HFC) is a prime example of a licensed agency that simplifies the process of navigating and applying for plans from California’s top health insurance carriers.

Its user-friendly platform enables you to compare various insurance options easily, ensuring it can find the best coverage for your staff via its patient, friendly and knowledgeable staff, and without the hassle of personally dealing with multiple providers.

By leveraging the tools and services available through HFC, your business can streamline the process to provide health insurance for employees in California. Doing so simplifies the provision of valuable employee benefits to your team while effectively managing costs.

“Needed to call into Health for California and I had the honor of being assisted by Gary. Not only was he professional and efficient, but Gary was kind, patient and helpful with answering all my questions. I felt he genuinely cared and made it such a pleasant experience.”

2 CaliforniaChoice

CaliforniaChoice (CalChoice) is a private health insurance exchange for small businesses, which allows you to offer employees a selection of plans from multiple health carriers within a single program.

They can select plans and carriers that suit their specific needs, with medical, dental, optical and life insurance bundled into one package for easier administration.

With CalChoice, you can control costs by setting fixed contribution amounts, allowing for more predictable budgeting. However, it may incur additional administrative fees that can be particularly challenging if you own a smaller operation.

“Now, more than ever, employees want choices when it comes to their health care coverage. Questions about our health care benefits are always a hot topic during the recruitment process. Offering various health care options can make a difference in securing quality candidates. That’s why we’ve selected CaliforniaChoice for our organization. It allows us to meet that growing employee expectation. The health insurance program gives our employees the freedom to select the coverage that’s right for them and their families. That flexibility means a lot.”

— Flor Real, Vice President Human Resources

3 eHealth

eHealth is a national online insurance broker offering a variety of health insurance plans for individuals, families and small businesses across the United States.

It offers a wide selection of plans from numerous carriers, helping its users find coverage that suits their needs. eHealth also assists with licensed agents who help you navigate the available options.

This tool supports modern solutions like Individual Coverage Health Reimbursement Arrangements, allowing you to provide more flexible health benefits to your staff.

However, as a national entity, eHealth’s focus isn’t exclusively on the nuances of state markets. This broader approach can be a disadvantage compared to specialized regional services.

“We immediately saw the value of these plans: they are affordable, employees can continue their plan (even if they leave the agency), and there are so many carriers and plans to choose from that these plans meet everyone’s specific healthcare coverage needs.”

— Sheryll Bombard, Operations Manager, AMAS inc.

How the Right Health Coverage Can Transform Your Workplace

In today’s competitive hiring landscape, you can change the game with the right health insurance coverage. Consider the following two scenarios that illustrate how effective plans can positively transform your workplace dynamics.

Scenario 1 — The Startup Competing for Talent

Imagine you command a small tech startup high on innovation, but struggling to attract top talent.

You’re in a fierce competition for a senior engineer possessing multiple offers from larger corporations. You realize that, while your enterprise may not be able to match the salary of the competition, you can offer something equally valuable — a flexible health insurance plan.

A health insurance marketplace can help managers provide prospective hires with the freedom to choose their own doctor and access specialized medical care. Presenting this valuable, personalized option can help make your open position more appealing to your sought-after candidate. It demonstrates a commitment to their overall well-being as an employee.

Scenario 2 — The Established Business Boosting Morale

Alternatively, consider that you own an established company facing low morale among team members.

After your management conducts surveys, you discover that many feel overworked and undervalued. As one step to address these concerns, you implement a new health plan that includes comprehensive mental health support.

The change is transformative, with your workers feeling heard and supported, leading to higher engagement and positive feedback in subsequent surveys.

The workplace atmosphere and environment shift from one of discontent to one of enthusiasm and enhanced collaboration. By investing in employee health coverage, you can create a working environment where everyone feels valued and motivated to contribute their best.

Regional Considerations — The California Example

Many factors influence the health insurance landscape, from state regulations and provider networks to market dynamics.

As a result, the environment can fluctuate substantially between states. If your business operates in California, understanding these nuances will help you select the right health insurance provider and plan for your region.

Navigating California’s health insurance market can be particularly challenging because of its regulatory complexity and the wide variety of available plans. For these reasons, tools like those offered by Health For California can help individuals select the best insurance plans without delays, making the agency truly stand out.

As a licensed agency specializing in the intricate California market, HFC provides you with a streamlined way to access health insurance plans from Covered California, which is the state’s official health insurance marketplace.

Instead of grappling with the sometimes-confusing government website, you can rely on its expertise to simplify the enrollment process.

Health for California acts as an authorized agent that helps you and your staff navigate the various Covered California options. This relationship streamlines the enrollment process, making it faster and easier, while providing you with expert, customer-centric support tailored to your specific needs.

With HFC, your employer status means you can confidently explore a range of plans from California-specific carriers to ensure you find the best fit for your workforce.

For instance, in addition to Covered California, HFC’s platform showcases a variety of other health insurance options from top carriers in California, allowing you to compare plans side by side.

This feature is invaluable if your organization is looking to provide comprehensive coverage while efficiently managing costs. Whether you’re a small startup or an established enterprise, an intimate understanding of the local health insurance environment helps to attract and retain talent.

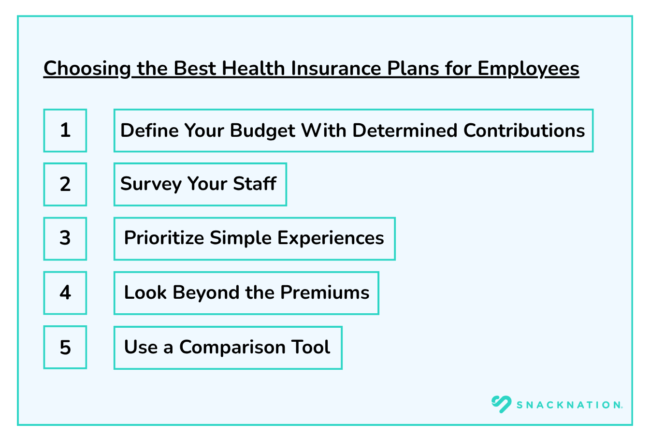

5 Tips for Choosing the Best Health Insurance Plans for Employees

Your informed decisions will help you select the best health insurance coverage that simultaneously benefits your employees and your organization. Here are five tips to assist in guiding you through the process.

1. Define Your Budget With Determined Contributions

By establishing a fixed dollar amount or percentage you’re willing to contribute, you’re able to control costs while still providing your workers with viable choices. This approach enables you to manage business expenses effectively while ensuring your team still has access to high-quality insurance coverage.

2. Survey Your Staff

You can gauge what matters most to your staff in their health insurance by conducting anonymous surveys that protect their privacy and confidentiality.

Whether it’s low premiums, network flexibility or specific coverage types — such as mental health, dental or optical — the results will help you understand their preferences and guide you in selecting the most suitable plans.

Pro-Tip: Explore SnackNation’s guide to employee survey tools to better gather information and make informed decisions.

3. Prioritize Simple Experiences

The best health insurance plans are always those that team members can easily understand and utilize. Consider solutions that provide clear information and straightforward access to benefits to ensure people can navigate their coverage with ease and minimal confusion.

4. Look Beyond the Premiums

Health insurance premiums are obviously an essential cost factor, but it’s necessary to consider more than these alone.

You must also factor in expenses like deductibles, co-pays, and out-of-pocket maximums to glean the all-around package benefits and expenses. Understanding the total potential cost for your workers helps you choose a plan that provides real value.

5. Use a Comparison Tool

Obtaining individual quotes from multiple health insurance carriers can be inefficient and time-consuming. By leveraging marketplaces or licensed agents, you can view all your options on a single platform. Streamlining your approach in this manner will save you time and help you find the best coverage without needless delays.

Conclusion

Choosing the right health insurance is a critical decision that impacts overall corporate success and team satisfaction.

Understanding the various plan options helps incorporate your staff’s choices and company costs. Utilizing available resources can easily identify your provider and plan selection, benefiting all concerned parties.

Remember that it’s not all about expense. Investing in decent insurance reveals your commitment and concern for your staff and forms a foundation for future success. What more could you want in a professional landscape that becomes more competitive with every passing day?

Frequently Asked Questions About Health Insurance Plans for Employees

Small businesses in California frequently ask questions about health insurance coverage.

Q: How many employees do I need to offer group health insurance in the state of California?

- A: In California, small businesses with one to 100 staff are eligible to offer group health plan coverage, also known as employer-based insurance. There is no minimum requirement for your organization to provide health insurance — entities with 50 or more full-time or equivalent team members need to offer coverage under the Affordable Care Act. As a small business owner, it is essential to understand your obligations and the benefits of providing health insurance to attract and retain top talent.

Q: What is the difference between a private exchange and the state marketplace?

- A: The core difference between a private exchange and the state marketplace lies in their structure and offerings. A private enterprise typically operates a private exchange and may offer a variety of plans from different insurers. State marketplaces are government-run platforms that provide access to health insurance plans specifically designed to meet state regulations.

Q: Can I get a tax credit for offering employee health insurance?

- A: Yes — if you own a small business, you may qualify for the Small Business Health Care Tax Credit, which is designed to encourage employers to provide health insurance. This is available through Covered California, and Health for California can help you access this benefit, which is worth up to 50% of your employee’s premium payment costs. It can significantly reduce the cost of providing health insurance, making it financially viable for many small employers.

Q: How much do I have to contribute to my workers’ premiums?

- A: While there is no hard and fast rule, you will typically share health benefit premium costs with your team, so you can work on paying around half of their premiums. Your contribution helps ensure they have access to affordable coverage while you manage your spending effectively. Sticking to this guideline means you can budget for health insurance offerings to benefit your bottom line.

![16 Best Employee Engagement Software Platforms For High Performing Teams In 2021 [HR Approved]](https://snacknation.com/wp-content/uploads/2020/11/16-Best-Employee-Engagement-Software-Platforms-For-High-Performing-Teams-In-2021-HR-Approved-e1605055461669-600x403.png)