The IRS Research and Development Tax Credit (R&D Tax Credit) is quietly saving companies hundreds of thousands of dollars in a sea of changes and tax reform, such as the Tax Cuts and Jobs Act (TCJA).

However, the vast majority of companies are sleeping on this opportunity mostly because of confusion surrounding the R&D Tax Credit and the factors that determine eligibility.

For starters, many business owners mistakenly believe that the R&D Tax Credit is exclusively for scientists and researchers.

Yet, the truth is that even small businesses and startups can capitalize on this tax credit and apply it to their tax returns. In fact, the R&D credit can help companies dealing in software development, quality improvements, the latest manufacturing methods, and more.

“Innovation is the creation of the new or the rearranging of the old in a new way.” — Mike Vance Click To TweetIn this article, we’ll clear up any confusion and misconceptions about expenditures, qualifying activities, how the credit can be used, and documentation. By gaining clarity regarding all things related to the R&D credit, you will feel confident moving forward and alleviating your company’s tax burden.

As you read through this R&D Tax Credit guide, you — like many business owners — might be shocked to discover how widely available this opportunity is and that you may be eligible for it.

Consult with your certified public accountant (CPA) and finance team to ensure that you remain compliant as you apply for your tax credit.

Now, without further ado, let’s go through everything you need to know to file your R&D Tax Credits for increasing research activities in 2024!

What is the R&D tax credit?

The R&D Tax Credit, as defined under Section 41 of the Internal Revenue Code, is a dollar-for-dollar reduction of a company’s tax bill, which deals with qualified domestic expenses around design, processes, development or improvement of products, formulas, software, or technique.

The Research and Development Tax Credit was permanently extended by the Protecting Americans from Tax Hikes (PATH) Act of 2015 (effective January 1, 2016) and broadened to enable more startups, qualified small businesses, and other types of organizations to capitalize on it.

How do research and development tax credits work?

Research and Development Tax Credits, sometimes referred to as Research and Experimentation Tax Credits, are an incentive offered by governments to organizations that invest in research and development activities.

The goal behind offering these incentives is to alleviate the financial burden of R&D expenses, thereby encouraging technological and scientific advancement and innovation — along with boosting the economy.

By reducing the cost of R&D, organizations can put even more of their precious resources, time, and energy into developing technologies, processes, and new products and services.

Another effect of RD Tax Credits is that they enhance the competitive landscape as a whole by increasing the likelihood of game-changing innovations that would otherwise be nearly impossible for small and medium-sized businesses to pull off without these economic incentives.

How to determine eligibility for R&D credits?

The R&D Tax Credit Four Part Test is the first test your application must pass. This criteria set is the minimum standard businesses have to meet for R&D Tax Credit eligibility.

The four parts, which we’ll expand on in a moment, are Permitted Purpose, Technological in Nature, Elimination of Uncertainty, and Process of Experimentation.

All four of the following parts have to be met to secure this dollar-for-dollar federal income tax liability reduction.

R&D Tax Credit Four-Part Test

Image Courtesy of Grennan Fender

1) Permitted Purpose

- Qualifying for the R&D Credit requires that the activities must relate to a new or improved business component’s composition, reliability, quality, function, performance, or invention. This type of advancement is designed to bolster innovation in your respective industry.

2) Technological in Nature

- The activity performed must depend on principles of biological sciences, engineering, computer science, or physical sciences. For instance, if you are in food production, minimal changes and adjustments to your process — like adding black pepper — aren’t your best path toward qualifying for the Research Tax Credit. However, a method grounded in hard sciences to amplify the flavors of your food could qualify, along with other science-based R&D improvements to your product.

3) Elimination of Uncertainty

- The activity needs to be for discovering information to eliminate uncertainty regarding the development or improvement of a product or process or the appropriateness of the product design. The key question that your business needs to answer is can you demonstrate that the product or process cannot be improved without going through this discovery process?

4) Process of Experimentation

- The taxpayer has to engage in a systematic process of experimentation that consists of analyzing one or more alternatives to achieve a desired outcome. Can your company demonstrate that it has gone through the process of elimination, evaluation of alternatives, or trial and error?

How to see if you qualify for Research & Development Tax Credits

To determine if you qualify for the Research Cost Reduction Credit, start by evaluating whether your business is involved in any activities that meet the R&D Tax Credit under federal law.

As we mentioned in the article intro, the Research Development Tax Credit is designated for activities involving the development of new products, software, processes, and technological innovations.

On top of that, companies have to pass the 4-part R&D Tax Credit test and incur qualifying expenses related to the specific R&D activity for which they are applying for a cost reduction credit.

RD Tax Credit Qualifications:

► Developing or designing new products

► Developing or improving upon existing prototypes and software

► Making enhancements to existing processes or products

How to claim your R&D Tax Credit in 2024

R&D Tax Credit Documentation

Outline the types of documentation you need — R&D Tax Credit documentation includes employee time and effort records, gross receipts, project descriptions, expenses related to projects, and more, which we’ll explain in the next several bullet points.

Additionally — and perhaps most significantly, you must provide detailed records of the experimental process, such as trial and error results along with technical challenges your team had to overcome throughout the project.

For this reason, businesses have to continuously evaluate and record their research activities to authenticate the costs incurred for each qualified research activity.

While some estimations may be necessary, even these estimations must have a demonstrable basis and logic that led to these assumptions.

Examples of documentation include:

- Payroll records

- General ledger expense detail

- Project lists

- Project notes

- Documents produced through the normal course of business

These records combined with credible employee testimony can form the basis of an R&D Tax Credit Claim.

RD Tax Credit Forms

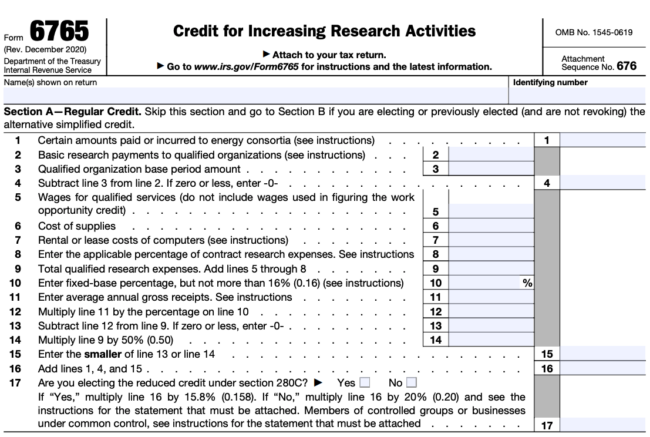

1) Form 6765

Form 6765 is used to calculate and claim the credit, and it requires detailed information about the qualifying expenses and activities. The form must be attached to the business’s tax return, and it is subject to review by the Internal Revenue Service.

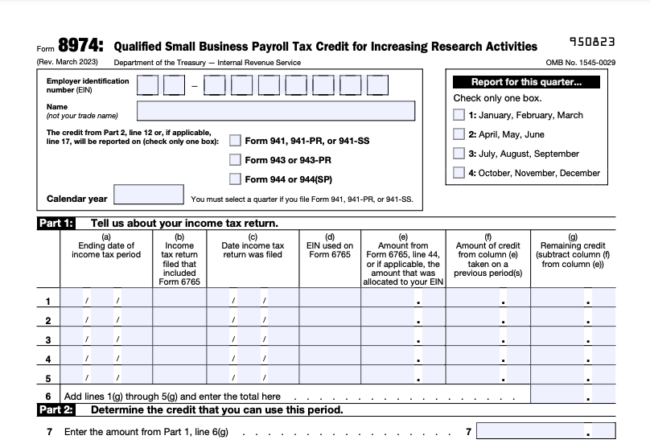

2) Form 8974

To claim the payroll tax credit related to the R&D tax credit, eligible small businesses must fill out Form 8974 and include it with their employment tax return for the relevant quarter. The form’s instructions must be followed closely for accurate completion.

Important things to know before filing your R&D Credits

What can the R&D credit be used for?

The government offers R&D credit to encourage companies to invest in research and development. This credit can help companies to reduce their income tax liability or AMT liability.

It can offset up to 20% of a company’s federal income tax liability. Some states also offer their R&D credits to offset state income tax liability.

What states offer R&D tax credits?

Presently, 38 states offer their own R&D Tax Credit in an attempt to boost business profits, job creation, and their local economies.

However, each state has different rules on which expenses qualify, the types of organizations that can apply, and how much the R&D Credit is worth.

The states that offer this incentive are: Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Texas, Utah, Vermont, Virginia, Wisconsin.

What is the R&D tax credits deadline in 2024?

You are required to claim the notification form within 6 months after the end of the relevant period for which you are making the claim. Failure to submit it by this deadline will result in an invalid claim, in accordance with the R&D Tax Relief changes starting on April 1, 2023.

What counts as qualified research expenses?

Qualified research expenses (QREs) are the expenses that a business incurs in conducting qualified research activities. QREs are typically applicable to many state-level R&D tax credits along with the federal R&D Tax Credit.

For example, the IRS considers wages, supplies, research-related expenses, and contract research expenses incurred in connection with the business or taxpayer’s wages to be qualified research expenses.

Are there R&D tax credit firms to work with?

Yes, there are R&D tax credit firms that specialize in assisting organizations in identifying and claiming R&D tax credits.

These firms typically have expertise in engineering, accounting, and tax law and are excellent at helping businesses prepare and file the necessary tax forms and pinpoint and document their eligible research expenses and activities.

Some of the main things to consider when selecting an R&D tax credit firm to work with are factors such as qualifications and experience, their track record of success with businesses that are similar to yours, references, case studies, and their fee structure.

Are there R&D tax credits for startups?

Yes, there are R&D tax credits available for startups.

For example, the federal R&D Tax Credit was specially designed to benefit small businesses and startups by offering credit to offset income tax liability for qualified research expenses.

On top of that, many states provide their own R&D tax credits that may be available to some early-stage businesses and startups in the form of refundable credit or the transfer of unused credits.

The unique nature of startups can make documenting expenses and research activities challenging; however, it can be done and should be considered throughout the R&D process.

Can I use R&D tax credits for software development?

Yes, R&D Tax Credits can be used for software development as long as the software development activities meet the requirements for qualified research expenses (QREs). Software development activities have to pass the 4-part R&D Tax Credit test, which includes technological uncertainty, technical nature, permitted purpose, and process of experimentation.

Some specific examples of eligible software development activities could be developing software to integrate with other technologies or systems, developing new algorithms, or improving the scalability or performance of existing software. This credit for increasing research activities is meant to be used across a wide range of sectors and software development is a prime example of a space that is driven by R&D and innovation.

People Also Ask These Questions About R&D Tax Credits

Q: Where can I find Form 6765?

Form 6765, also known as the Credit for Increasing Research Activities, can be found on the IRS website. You can download a copy of the form and its instructions in PDF format from the website.

The IRS website also gives extra information regarding the calculation of the credit, eligibility requirements, and documentation requirements for the Federal Technology Investment Incentive.

Q: What is my R&D tax credit calculation?

R&D Tax Credit calculations can be fairly complicated, largely because it depends on many factors, including the extent of your QREs, any limitations and applicable adjustments, and the credit rate available for your business.

The federal R&D tax credit is usually calculated as a percentage of your QREs for the tax year. Currently, this rate sits at 20%, but it can vary depending on a variety of factors, such as your business’s history and more.

To calculate your Qualified Research and Development Expenditure Benefit, you will need to identify and document your QREs for the tax year. After you’ve done that, you need to apply the appropriate credit rate and any applicable adjustments or limitations to arrive at the correct credit amount.

Q: What are some qualified activities for the R&D tax credit?

Many qualified activities make a company eligible for the R&D Tax Credit.

For instance:

- Developing or improving environmental or energy-saving technologies

- Designing new processes or improving existing ones

- Conducting scientific studies or experiments

- Improving existing product quality or reliability

- Developing or improving new materials or substances

- Developing or improving manufacturing techniques or processes

- Inventing new prototypes or products

- Creating or improving computer programs or software

Q: How can I receive innovation tax credits?

You can receive your R&D Tax Credits, also known as Innovation Tax Credits by determining if your business is eligible first, identifying your qualified research expenses, documenting your research and development activities, calculating your credit, and lastly, claiming the credit on your tax return using Form 6765.

Q: Where can I get started with an R&D tax credit company?

Finding an R&D Tax Credit company to assist you with your RD tax credits claim consists of a few critical steps. First, research R&D Tax Credit companies. Schedule a consultation to discuss your business’s eligibility and potential Innovation Tax Credit amount. Next, provide documentation, work closely with the R&D Tax Credit company, and receive your research credits.

Q: What are some R&D Tax Credits Examples?

There are a multitude of industries and verticals that R&D Tax Credits can apply to. Of course, any industry in which technological, scientific, and other breakthrough innovations are pushed forward may qualify.

While that explanation may sound broad, that’s because it is and could be applied to many types of businesses because of it. After all, these are financial incentives designed by the government to encourage businesses to invest in research and development activities. Some R&D Tax Credit examples include but are not limited to biotechnology, medical devices, and pharmaceuticals.

Q: How do I account for R&D credits on taxes?

To account for R&D credits on your taxes, complete Form 6765, the designated form for claiming the credit.

Determine your qualified research expenses (QREs), calculate your R&D Tax Credit, complete Form 6765, apply the credit to your taxes, and keep proper documentation to account for and receive the Technological Advancement Credit.

Q: How do I apply for R&D tax credits in 2024?

To apply for R&D Tax Credits in 2024, you will need to follow these general steps: determine if you are eligible; identify your qualified research expenses; document your R&D activities; calculate your R&D Tax Credit, complete Form 6765; file your tax return; and keep proper documentation.

The Research and Development Expensing Allowance requirements for claiming the R&D Credit vary depending on the type of business and the particular activities you have performed.