The least fun part of starting a business is setting up anything related to administrative duties — especially payroll.

Conducting payroll is consistently one of a new founder’s most challenging obligations. Not to mention one of the highest costs a business incurs.

In fact, entrepreneurs allocate approximately 40% of their work hours to non-income-generating activities, including responsibilities like recruitment, HR tasks, and payroll management.

To help you sort through hundreds of payroll software options, we’ve compiled a list of all the payroll solutions that meet the core needs of startups.

We’ve taken into account:

- Must-have payroll features to handle needs that startups will likely have

- Other features that should always come with payroll (e.g., benefits management)

- Ease of use and general user sentiment

Before you skim through our list, quickly note three essential payroll challenges you have or are expecting. These will guide the process as you choose two to three platforms to demo before you opt for one that will scale alongside your company.

So, did you identify the three payroll challenges you regularly experience? Now, let’s find the perfect payroll software to help you overcome them!

Page Contents (Click To Jump)

Best Payroll Software for Startups

We’ve hand-picked some of the best payroll software startups should use by considering the essential features any small business will need. Here’s a detailed look at what each payroll tool will bring to the table:

1. Papaya Global

Papaya Global is a global payroll and workforce management platform that provides a comprehensive solution for managing and automating various aspects of hiring internationally, HR, and employee benefits such as PTO. What’s the tool’s main goal? To simplify the complexities of managing payroll in multiple countries, including compliance with local regulations and tax requirements.

🏅Why this is a good payroll software for startups: With some of the lowest costs (for startups) on this list, Papaya Global can help you reduce payroll costs. It remains available for you to use when your team grows to the enterprise level. The best part is that security features such as SOC2 and GDPR compliance are available for all plans, so you can rest assured that your employee data is safe.

Standout Features

- Global payments

- Employer of record

- Immigration, global benefits, and equity management

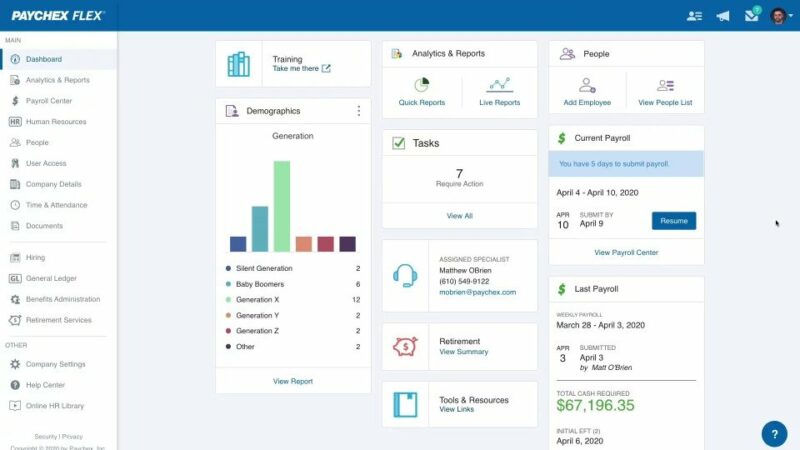

2. Paychex

Paychex is a platform that allows businesses to manage payroll processes, including calculating wages, taxes and tax forms, health insurance, and other benefits. The tool can assist startups as they hire new team members, retain top performers, or try to keep up with the ever-changing laws and regulations.

🏅Why this is a good payroll software for startups: Paychex was primarily built to help companies process payroll. This means they excel in the payroll process, but they were also able to scale their platform in time. You can now choose this tool if you want solid payroll but still want to handle other processes, such as talent management or benefits planning.

Standout Features

- Benefits management and compliance

- Employee background screening

- Payroll tax administration

3. OnPay

OnPay is a payroll software designed for small businesses to run payroll, manage employee benefits, and handle other human resources tasks. Notably, OnPay offers features such as automated payroll processing, tax filing services, time tracking, and employee self-service.

🏅Why this is a good payroll software for startups: Besides the fact that OnPay boasts one of the best customer support services and is super user-friendly (as per user reviews), we particularly like the robustness of the employee self-service features. These let employees access their payroll information, tax documents, and other relevant details online, reducing the administrative burden on startup HR teams.

Standout Features

- Automated tax filling

- Benefits administration

- Unlimited payroll runs

4. Rippling

Rippling’s platform is designed to help with the entire employee lifecycle, from recruitment and onboarding to attendance tracking, payroll and pay stubs, and benefits management. The HR software app strongly relies on automation to help you speed up the most time-consuming processes and comes with a series of templates (internally called recipes) that can help you set up new workflows instantly.

🏅Why this is a good payroll software for startups: With an extensive team of in-country compliance experts, Rippling is one of the best payroll solutions for staying compliant with HR and employment regulations. Specifically, Rippling does things that competitors don’t to solve your business needs.

These include automatically calculating overtime in every country, keeping tax payments timely, sending alerts if employees are being paid under the minimum wage, integrating with the necessary payroll providers, and assigning country-specific compliance training to employees.

Standout Features

- Automatic tax filing

- GL (General Ledger) integration for global spend

- Custom workflows to automate most payroll (and HR) processes

5. ADP

ADP is a global provider of HR and payroll services, offering a wide range of payroll capabilities for businesses of all sizes, including small businesses. The ADP Payroll Services for Small Businesses plan is designed to provide comprehensive payroll solutions to help small businesses and startups manage their payroll processes.

🏅Why this is a good payroll software for startups: ADP lets you complete your payroll effortlessly with a few clicks or opt for automatic processing, with taxes filed on your behalf. The tool stands out because you can enjoy the benefits of an automated online payroll system that minimizes the risk of costly errors while connecting it to ADP’s bigger HR suite to leverage other features such as recruitment and hiring, employment verification, and workforce management.

Standout Features

- Automated online payroll

- GlobalView® Payroll (for global payments and employee management)

- Benefits administration

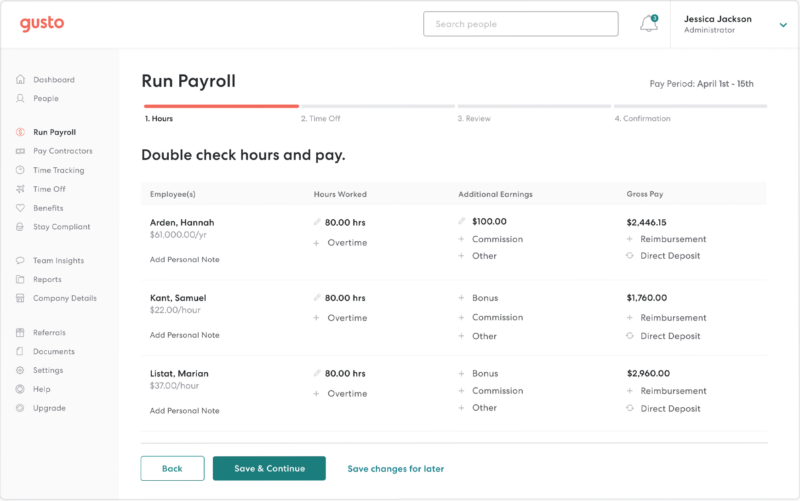

6. Gusto

Gusto is a human resources software that helps small businesses (although there are options to scale) with hiring and onboarding, talent management, time and attendance tracking, employee benefits, and full-service payroll. This means you can easily pick Gusto if you want an all-in-one solution to handle multiple aspects of HR.

🏅Why this is a good payroll software for startups: Gusto is heavily reliant on the value of time tracking. Its automated time management tools calculate your team’s hours, paid time off, holidays, and more to benefit business owners like you. Plus, they integrate with various time-tracking apps while ensuring employee privacy compliance. This makes it a perfect startup payroll solution if you’re looking to pay hourly workers and sync team hours automatically.

Standout Features

- Automatic tax calculations

- Unlimited payroll runs at no additional cost

- Direct deposits

7. QuickBooks

QuickBooks is an accounting software designed for small and medium-sized businesses to help them manage their financial tasks efficiently. It offers a range of features to handle bookkeeping, invoicing, payroll, and other financial processes.

🏅Why this is a good payroll software for startups: We love QuickBooks because it has some of the most advanced payroll features on the market. These include the ability to calculate employee salaries, manage tax withholdings, and handle payroll tax filings. On top of this, QuickBooks is one of the few HR tools and payroll apps out there that natively integrates with a large variety of third-party solutions, making real-time data integration faster and more reliable.

Standout Features

- Single-touch payroll

- Swap app (for employees to manage leave, payslips, timesheets, and expenses even on the go)

- Advanced payroll (with pre-built awards, wage overviews, attendance tracking, payroll reports, payroll data, and more)

8. Oyster

Looking for an employer of record? Oyster provides cloud-based global employment solutions for businesses with remote or distributed teams. As an HR solution, they take on the legal responsibilities of employing workers on behalf of a company, handling tasks such as basic payroll and advanced payroll needs, tax compliance, and benefits administration.

🏅Why this is a good payroll software for startups: While handling payroll for a distributed team can be challenging, you can use Oyster to hire anyone, anywhere. This intuitive platform helps startups manage the complexities of employing remotely, ensuring compliance with employment laws and regulations in various countries.

This is especially beneficial for startups that do not have the infrastructure or expertise to handle global payroll and workers’ compensation yet.

Standout Features

- Compliant payroll in 140+ currencies

- Employer of record services

- Contractor conversion and talent network

Benefits of Payroll Software for Startups

The main reason why startups need payroll software from the start is that your small team won’t have the time to handle payroll manually.

Sure, you can work with a payroll service provider, but a digital solution will help you save money and track all payroll activity in one single place, particularly as you scale.

Some other reasons why payroll software is beneficial for startups include:

Benefit #1: Having more accurate data

While manual payroll processing is prone to errors, payroll software minimizes issues through consistent calculations and automation.

Benefit #2: Ensuring tax compliance

With integrated tax calculation features, all taxes are calculated accurately and on time, reducing the risk of non-compliance.

Benefit #3: Scaling as you grow

As your startup grows, payroll software can handle increasing employees, the administrative side of onboarding new hires, and adapting to changes in tax regulations and other compliance requirements.

Benefit #4: Keeping employee information secure

Thanks to robust security features (check your tool’s security policy.) to protect sensitive employee information, ensuring compliance with data protection regulations is a breeze.

Benefit #5: Maintaining an audit trail

Detailing your payroll data and payment history ensures that your company maintains a clear record of all payroll transactions that streamlines internal audits or regulatory inquiries.

People Also Ask These Questions About Payroll Software for Startups

Q: What Is payroll software for startups?

- Payroll software for startups is a digital platform designed to automate and speed up the process of managing diverse payroll-related tasks for a small business. This software often comes with a dedicated plan tailored to meet the specific needs of startups, considering factors such as scalability, ease of use, and cost-effectiveness.

Q: What are the main features to look for in payroll software for startups?

- A: Any payroll software for startups should come with a couple of core functionalities. These include automatic tax calculation, accounting capabilities, automated payroll, and reporting. Depending on the size of your team and what countries you’re hiring in, you’ll also want to consider features such as global payments or support for different employment models.

Q: How do I set up a payroll system for my small business?

- A: Start by correctly classifying your employees as full-time, part-time, temporary, or contract workers. Each will have different payroll requirements that you must clarify before deciding on a payroll schedule. From here, your payroll software of choice will guide your next steps. This will include setting up employee records, deducting any taxes or withholdings, picking benefits, distributing paychecks, and tracking all payments.

Q: How does payroll software integrate with other systems in a startup?

- A: Most payroll platforms have native integration with third-party tools you’re already using. However, it’s important to double-check that your new payroll solutions integrate with your HRIS, accounting, resource management, and project management/time tracking apps. If native integrations are missing, you also have the option to look into app connectors such as Zapier, but they won’t perform as well as native integrations do.

Q: How does payroll software help with compliance and tax reporting?

- A: Payroll software is designed to calculate various taxes automatically, including federal and state income taxes, Social Security, and Medicare taxes. The software considers the latest tax rates and rules, reducing the risk of errors in tax calculations, but it’s important to check if the tool is compliant within your region. Payroll software also often comes with compliance features that alert users to regulatory changes and help with filing and reporting taxes.

Q: What are the costs associated with implementing payroll software at a startup?

- A: The costs associated with implementing payroll software in a startup largely depend on the tool you’re using. For instance, a simple payroll and bookkeeping bundle with QuickBooks is $75/month (for the base price) and an extra $6/employee/month. Meanwhile, with an employer of record service like Oyster, you’re looking at $599/month/employee when you’ve got a team with fewer than five members. Larger teams are almost always subject to custom pricing. The setup process is most often free.