Tax regulations are complicated. Knowing what to do about deductions, withholdings, and reporting requirements can be overwhelming; however, the right payroll software can ensure adherence to these regulations, minimizing the risk of penalties and legal complications.

Furthermore, time is money.

HR tools with features dedicated to 1099 employees can automate repetitive tasks, such as calculating wages, generating tax forms, and processing payments, freeing up valuable time you can invest in core business activities.

Page Contents (Click To Jump)

What Is Payroll Software for 1099 Employees and Contractors?

Payroll software for 1099 employees and contractors is a tool dedicated to speeding up and automating the payment process for independent workers.

It allows organizations to easily manage payments to contractors by automating tasks such as calculating payments based on contract terms, scheduling automatic payments, onboarding new hires and contractors, or generating and distributing tax forms like Form 1099-MISC or Form 1099-NEC.

Benefits of Using 1099 Payroll Software

👍 Making payments easier

The right payroll software streamlines payment schedules, direct deposits, rates, and invoicing methods, allowing you to efficiently manage payments and compensate contractors on time.

👍 Ensuring compliance

Payroll software tailored for contractors automates tax withholdings and payroll taxes, generates accurate tax forms, and keeps track of regulatory changes to minimize the risk of penalties and legal issues associated with misclassification or improper tax reporting.

👍 Improves contractor experience

By using efficient payroll software, you can pay employees and contractors in a timely manner, give prompt responses, build trust, and attract top talent.

👍 Saves you time

Manual payroll processes are automated by good payroll software, which automates repetitive tasks such as data entry and calculation, freeing up valuable time for business owners and HR professionals to focus on strategic initiatives.

👍 Keeping detailed records

Independent contractor payroll software maintains accurate records of payments made to contractors so you can easily track expenses, reconcile accounts, and prepare for tax filings.

Best Payroll Software for 1099 Employees

1 Deel

Deel is a platform that simplifies global hiring and payroll processes for remote teams and contractors. Specifically for contractor payroll, Deel offers features such as automated payments, compliance management, tax calculations, and contract generation.

✅ Why this is an effective 1099 payroll software: Deel helps ensure compliance with local labor laws, tax regulations, and employment standards across multiple jurisdictions, making it suitable for businesses hiring independent contractors globally. The platform also automates tax calculations for contractors, so you will have accurate withholding and reporting to tax authorities.

🏆 Standout features:

- Shield: Correctly classify and hire contractors in 150 countries.

- Team experience: Grant contractors access to a Deel Card, enabling them to securely use their earnings online or in physical stores while also maintaining their balance in USD for increased stability.

- Invoice and payments: Save time and generate digital invoices instantly for every payment to effortlessly synchronize all your payroll data with your preferred accounting software.

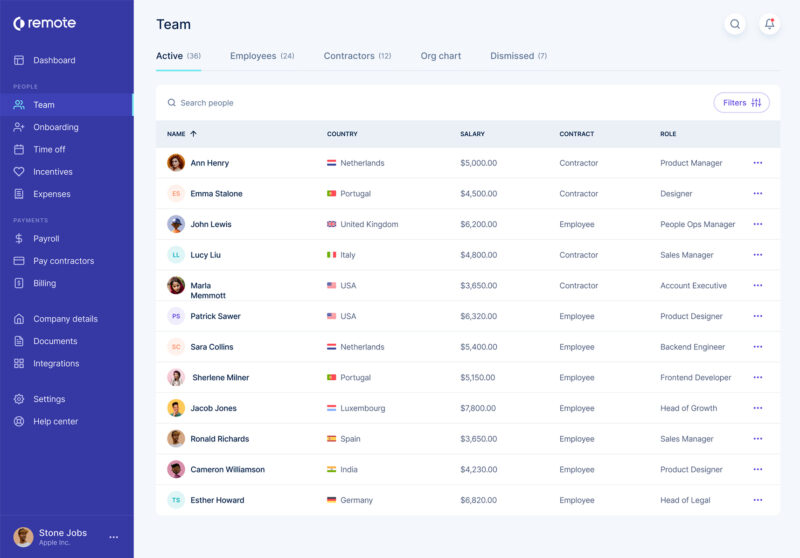

2 Remote

Need an employer of record? Remote provides extensive employment services tailored for businesses with remote or dispersed teams. Their offerings encompass taking on the legal responsibilities of employing workers on behalf of a company and overseeing functions such as payroll processing, Quickbooks payroll, tax compliance, health insurance, and benefits administration.

✅ Why this is an effective 1099 payroll software: Remote proves especially beneficial for remote teams or companies frequently collaborating with international contractors. Their features are crafted to facilitate strong engagement with top talent globally, spanning from initiating contracts/employment to maintaining timely payments.

🏆 Standout features:

- Contractor invoicing and payments: Automate invoicing and pay freelancers faster.

- Contractor management plus: Get enhanced compliance by engaging contractors in over 200 countries and territories with indemnity protection against misclassification.

- Time and attendance tracking: Track time off, monitor compliance, and record time in any timezone.

3 ADP

ADP’s WorkMarket product is a comprehensive workforce management platform designed to streamline the process of managing freelance, independent contractor, and contingent workers. This payroll software for 1099 employees provides businesses with a centralized platform to efficiently engage, onboard, manage, and pay freelancers and independent contractors.

✅ Why this is an effective 1099 payroll software: ADP lets you cover the entire contractor lifecycle — from attracting talent to paying them. Their onboarding module stands out in particular as a unique addition compared to similar payroll tools. WorkMarket allows you to create branded recruitment pages showcasing available opportunities and automate the verification process for US tax ID, Form W-9, and bank account information. Additionally, it provides visibility into worker progression during onboarding and enables bulk onboarding for scaling operations.

🏆 Standout features:

- Organize talent: Organize workers into customizable Labor Clouds based on specified criteria such as skill sets, certifications, location, and assessments.

- Manage work: Manage large workloads by utilizing templates and automated workflows.

- Pay: Choose from flexible payment options and evaluate expenditure across projects, clients, and contractors to gauge costs and profitability.

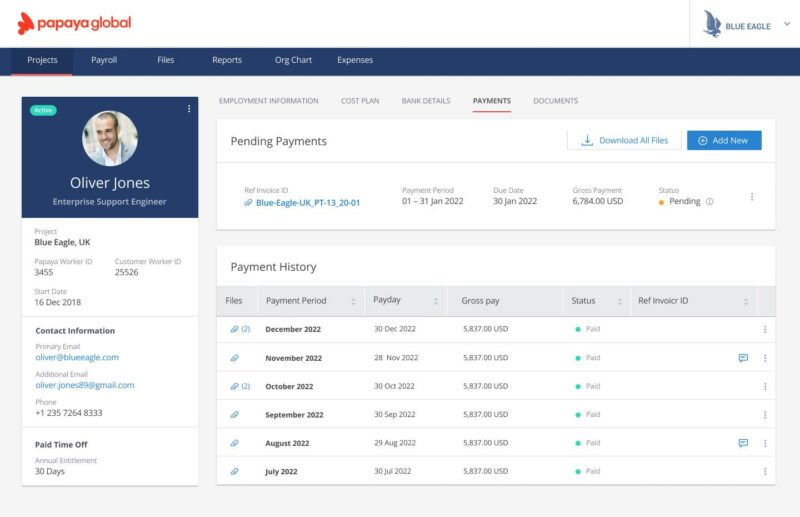

4 Papaya Global

Papaya Global is a cloud-based platform offering global payroll systems, employment management, and workforce management solutions for internationally-operated businesses. It provides a comprehensive suite of tools to streamline human resources and payroll processes, including managing employee payroll, PTO, employee benefits, compliance, and employee data across multiple countries and currencies.

✅ Why this is an effective 1099 payroll software: This payroll software for independent contractors is one of the few similar solutions for fraud protection. By integrating this additional layer of security into its platform, Papaya Global helps businesses safeguard their financial transactions and sensitive data against potential fraudulent activities, enhancing trust and confidence in the payroll process.

🏆 Standout features:

- Contractor management: Onboard w-2 employees, manage pay stubs and paychecks, and pay contractors from one full-service payroll hub.

- Global workforce wallet: A workforce account to help you pay in 12 currencies across 160+ countries.

- Compliance: Use dedicated 1099 contractor payroll services to stay safe, regardless of the countries your contractors are active in.

5 Multiplier

Multiplier provides rapid freelancer onboarding, compliance, invoicing, and payment processing. With this tool, you can effortlessly initiate freelancer payments across 150+ countries through a single intuitive and all-encompassing dashboard. Plus, this payroll software lets you offer perks such as localized insurance.

✅ Why this is an effective 1099 payroll software: Multiplier’s accurate assessment tool lets you employ freelancers without risking worker misclassification. If you’re uncertain whether your next recruit should be brought on as a freelancer or an employee, you can also run a brief assessment directly within the Multiplier platform.

🏆 Standout features:

- Expense filing and reimbursement: Freelancers can easily submit expenses for reimbursement, making it easier for you to reimburse them quickly and efficiently.

- Global compliance: This HR software helps you comply with local labor laws and keep your data secure.

- Global payroll: Pay contractors on time whenever you run payroll globally and never miss another payday with Multiplier.

6 QuickBooks

QuickBooks, an accounting software tailored for small businesses as well as medium-sized businesses, facilitates efficient management of financial tasks, providing various tools for bookkeeping, invoicing, payroll, and other financial operations.

✅ Why this is an effective 1099 payroll software: The tool makes it super easy to start immediately, even when you have minimal experience working with contractors. For example, QuickBooks provides customizable templates for generating 1099 forms, making it simple for businesses to create and distribute accurate tax documents to contractors.

🏆 Standout features:

- Set up: In both QuickBooks and QuickBooks Contractor Payments, you can establish your contractors as vendors and track all associated payments

- Vendor expenses: Separate contractor payments from other costs to simplify the process of issuing and filing precise 1099 forms for the tax year.

- Print and mail 1099 forms: Buy official 1099 forms directly within QuickBooks and print them using your printer.

People Also Ask These Questions About Payroll Software For 1099 Employees

Q: What are the key features to look for in payroll software for 1099 employees?

- A: When selecting payroll software for 1099 employees, key features to consider include tax compliance, contractor pay management, expense tracking, clock in and time tracking, and payroll reports. You’ll also want a tool that integrates with the third-party apps you’re using and can offer robust compliance and security capabilities.

Q: How can payroll software for 1099 employees improve payment efficiency?

- A: Payroll software designed for 1099 employees can significantly enhance payment efficiency by automatically calculating payments based on contract terms, hourly rates, or project milestones, eliminating manual calculations and reducing the risk of errors. Specific payroll solutions may offer electronic invoicing capabilities and integrate with the accounting systems you’re already using.

Q: What are the common challenges in managing payroll for 1099 employees and how to overcome them?

- A: Some common challenges include proper tax compliance, correctly classifying contractors, paying 1099 employees on time, and handling expense reimbursement. You’ll want to opt for extensive payroll software to overcome these challenges and implement proper contracts and agreements when starting to work with a new freelancer.

Q: How does payroll software for 1099 employees support compliance with tax laws?

- A: Payroll software for 1099 employees supports compliance with tax laws by automatically calculating local taxes based on contractor earnings and tax rates, ensuring accurate withholding, and reducing the risk of errors. Payroll software can also generate and file tax forms, such as Form 1099-MISC or Form 1099-NEC, on behalf of employers. Furthermore, such tools can maintain detailed records of contractor payments, tax withholdings, and tax documents or send compliance alerts to notify employers of tax laws or regulations changes.