To scale your organization globally and find the best people, your search has to expand far beyond your local talent pool.

However, to do so, you must be able to handle global payroll. Often, that challenge stops or delays many companies from going international.

There are loads of facets when it comes to global payroll. Most companies plan to improve their global payroll’s data security, integration, and quality over the next few years, from paying employees fairly to ensuring they get their money on time and staying compliant.

Read on to discover all the intricacies of global payroll and actionable solutions to common challenges.

This guide will also dive into a few of the top global payroll software options and their core use cases.

Page Contents (Click To Jump)

What Is Global Payroll?

Global payroll is a system or process that multinational companies use to manage and centralize how they pay employees across different countries.

It calculates, processes, and distributes salaries, bonuses, and other employee benefits in various locations, considering local tax laws, currency exchange rates, and other regulations.

Global payroll helps companies speed up and standardize their payroll operations, ensuring compliance with local laws and regulations and providing a more efficient and accurate way of compensating their global workforce.

Benefits of Using Global Payroll Software

The use of global payroll software brings a plethora of advantages to companies of all sizes. So, no matter if you’re a startup that’s working remotely and has a distributed team all over the world or an enterprise-level organization, here are some benefits you can leverage:

✅ Saving time

Global payroll software automates the payroll process, eliminating the need for manual calculations and data entry and reducing the number of errors or mistakes in the meantime.

✅ Ensuring compliance with local laws

This software type is built to help you comply with local laws and regulations, ensuring accurate and fair payroll processing.

✅ Keeping your people data secure

Most global payroll tools have built-in security features to protect sensitive payroll data, minimizing the risk of data breaches and ensuring the confidentiality of your employees’ information.

✅ Reducing costs

By automating the payroll process, you can save on hiring additional staff or building an in-house team just for payroll processing.

✅ Connecting your data to other tools you’re already using

Global payroll software can be integrated with other accounting solutions, HRIS systems, and HR apps, making managing employee data and financial records in one place easier.

Best Global Payroll Software Tools

We’ve carefully selected five global payroll software options that you can consider by considering the must-have and nice-to-have features most international businesses will need. Let’s delve into the specific offerings of each global payroll tool:

1. Multiplier

Multiplier is a platform that exclusively focuses on handling your global teams’ payroll, payslips, taxes, and social contributions and providing local expertise for local insurance rules. This payroll service provider lets you onboard, pay, and offer benefits within different countries while keeping everyone connected.

❤️ Why this is a good global payroll software tool: We love this payroll partner tool because it thinks of every small detail. For instance, you can access multilingual, compliant contracts developed by legal experts to speed up the hiring process. There’s also a dedicated module for managing expenses, leave, and time sheets. Employee stock ownership plans, global compliance, and freelancer hiring are also covered.

🏅 Standout features:

- Global expansion

- Global payroll

- Global hiring and Employer of Record (EOR)

2. Paychex

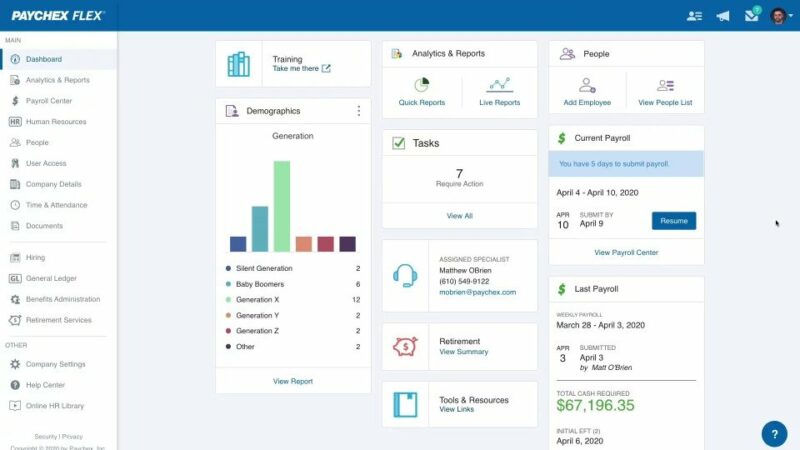

Paychex is a versatile platform designed to help businesses effectively manage their payroll operations and payroll administration. This includes calculating wages, taxes, and benefits like health insurance. The tool will help you with the entire employee lifecycle process, from hiring and retaining valued employees to staying up-to-date with constantly evolving laws and country-specific tax regulations.

❤️ Why this is a good global payroll software tool: Paychex offers real-time 24/7 support to its users, ensuring that businesses can get assistance at any time, regardless of their time zone. Their support team is trained and knowledgeable about international payroll processes, regulations, and compliance requirements.

🏅 Standout features:

- PEO and HR outsourcing

- Global payroll and benefits

- Worldwide employee background screening

3. Rippling

Rippling‘s platform was created to assist with all aspects of the employee journey, including recruitment, onboarding, attendance tracking, payroll, and benefits management. The app heavily relies on automation to streamline processes. It offers various pre-made templates (called “recipes”) to set up new workflows quickly and make running payroll a breeze.

❤️ Why this is a good global payroll software tool: Thanks to its large team of in-country compliance experts, Rippling is a leading payroll solution for companies looking to ensure international compliance with HR and employment regulations. Unlike its competitors, Rippling offers unique features such as automatic calculation of overtime in all countries, alerts for employees being paid below the minimum wage, and tailored compliance training for each country.

🏅 Standout features:

- Global payroll

- PEO services

- Global workforce analytics and dashboards

4. Papaya Global

Papaya Global is a comprehensive payroll and workforce management platform designed to simplify the process of hiring internationally, managing HR, and providing employee benefits. The main objective you can achieve with this tool is to speed up the complexities of multi-country payroll, such as meeting local regulations and tax obligations.

❤️ Why this is a good global payroll software tool: Besides the actual features, Papaya Global has an entire team of payroll experts to support your global employment efforts. Users report they’re quick in answering queries and can act as a consultants when needed. This, together with all the extra information you can find for specific countries, will help you ensure compliance with local laws and regulations for national and international employees alike.

🏅 Standout features:

- Global payments

- Employer of record

- Immigration, global benefits, and equity management

5. Oyster HR

If you’re looking for an employer of record, Oyster offers comprehensive employment services for companies with remote or dispersed staff. Their services include assuming the legal obligations of employing workers on behalf of a business managing tasks like payroll, tax compliance, and benefits administration.

❤️ Why this is a good global payroll software tool: Oyster is particularly handy for remote teams or companies that regularly work with international contractors and deal with global payroll management. Each of their features is designed to help you work with the best talent worldwide, from setting up the initial contract or employment to getting them paid.

🏅 Standout features:

- Compliant payroll in 140+ currencies

- Employer of record services

- Global contractor management

What Are the Challenges of Global Payroll?

But, like any other administrative task, global payroll comes with challenges. Next, you’ll find a brief analysis of the most common challenges of global payroll and how you can handle them using the latest global pay platforms.

Challenge #1: Ensuring compliance with all local laws and regulations

One of the biggest challenges of global payroll is ensuring compliance with the constantly changing laws and regulations of different countries. Each country has its own tax laws, employment laws, and labor regulations that must be adhered to, making it a complex and time-consuming process, especially since they tend to change so often.

👍 Solution: Ensure the global payroll you’re testing is regularly updated to keep up with changing laws. Additionally, it would be best if the tool gave you access to a list of payroll experts in every country so you could clarify further issues or edge cases.

Challenge #2: Handling multiple currencies and exchange rates

With employees in different countries, global payroll also involves dealing with multiple currencies and exchange rates. This can make it difficult to accurately calculate salaries, taxes, and other payments, leading to potential errors and discrepancies.

👍 Solution: Seek a global payroll solution that automatically converts salaries, bonuses, and other financial transactions from local currencies to a common currency, streamlining the process and ensuring accuracy. Just make sure to double-check the currencies you will use to pay employees.

Challenge #3: Ensuring only the people who have the rights and appropriate roles will access sensitive data

With sensitive employee information being shared across borders, data security, and privacy have become major concerns in global payroll. Companies must ensure that their payroll processes comply with data protection laws and that employee data is always kept secure.

👍 Solution: One option is to delegate certain team members to handle payroll and apply common data security best practices. This can become an extensive and even costly process, though. So, your best bet is to pick a payroll platform with role-based access control, allowing administrators to define roles with specific access permissions. This ensures that individuals only have access to the payroll data relevant to their roles, reducing the risk of unauthorized access.

Challenge #4: High administrative costs

Handling global payroll via an outsourced company or firm can be expensive, as it requires a lot of resources and expertise to handle different countries’ complex and diverse requirements. Hence, you should make sure that these additional costs don’t become a burden on your finances.

👍 Solution: One option to allocate fewer resources to the payroll process is to work with an individual consultant or a smaller firm. This is only acceptable if you’re just starting and don’t have a lot of employees yet. As you scale, you’ll want to opt for a digital global payroll solution to cut costs. Remember, these won’t be cheap either, but prices tend to be more affordable.

Challenge #5: Keeping employees happy and making sure they’re paid fairly

Inaccurate or delayed payrolls can lead to employee dissatisfaction and turnover, which can be extremely costly. To avoid losing your team’s trust (and even their leaving altogether), it’s crucial to ensure that global payroll processes are efficient, accurate, and timely.

👍 Solution: Strive for pay equity by ensuring that employees performing similar roles receive fair and equal compensation, regardless of location. You should also adopt a transparent compensation policy to communicate how salaries are determined, what performance-related bonuses you’re offering, and how inflation or cost of living differences affect their salary. Pair all this with a digital tool that can update you in case employees aren’t paid the minimum wage in their country and also automate the payroll process so they can get their money on time.

Tips When Using Global Payroll Services

Not sure where to start? Here are our best tips for using global payroll services so you won’t have to worry about missing anything:

1) Choose a provider with good reviews

Select a reputable global payroll service or software provider with experience managing payroll processes across various countries.

Look for providers with a track record of compliance and customer satisfaction by checking out online reviews or networking with other founders to see what solutions they’re using.

2) Understand compliance and regulations

Double-check that the service complies with all relevant laws and regulations in the countries where you have employees.

3) Check for data security measures

SOC 2 and GDPR are two must-have examples.

The global payroll system and service provider have strong data security measures (for every country you’ve got employees in) to protect your employees’ sensitive information.

4) Consider scalability

If your company is growing, it’s important to choose a global payroll service that can grow with your business instead of a single consultant or busy firm that won’t have the bandwidth to handle it all.

5) Review the solution occasionally

How they operate will likely change whether you’re using a software or payroll service company.

Regularly review and evaluate their performance (as well as any new features or policies) to ensure they meet your expectations and needs.

People Also Ask These Questions About Global Payroll

Q: What is the difference between global payroll and local payroll?

- A: Global payroll involves managing payroll for employees on a worldwide level. Multinational companies often use this with employees in multiple countries or organizations trying to consolidate a team globally. Local payroll is more targeted, focusing on every country’s unique payroll requirements. This can include staying up-to-date with local labor laws, taxes, and compliance requirements and managing payroll for employees in that location.

Q: What are the different types of global payroll providers?

- A: The fundamental types of global payroll providers you should look into include global payroll outsourcing companies, in-country payroll providers, global PEO companies, global payroll software providers, classic accounting services, and even freelance consultants.

Q: How do you ensure payroll compliance with local labor laws?

- A: To ensure compliance, the most important thing is to stay informed about the varying labor laws and regulations in each country where you have employees. Based on these changes, you’ll want to keep policies and procedures up-to-date to reflect anything new in local labor laws. Next, investing in a good international payroll system or software that can help automate and centralize payroll processes is important. Alternatively, you can also collaborate with local legal and tax experts knowledgeable in the labor laws of each country you’re hiring in.

Q: How should you track your global payroll costs?

- A: The easiest way to track your global payroll costs is to use global payroll software to automate this process so you won’t have to monitor everything manually. A digital solution can ensure you’ve got a central place to store all sensitive payroll information, automatically run audits on your behalf, notify you when a law or regulation changes, help you handle reporting, forecasting, or budgeting, and so much more.

Q: What is a global PEO?

- A: A global PEO (Professional Employer Organization) is a service provider offering extensive human resources, payroll, and employment outsourcing solutions to companies with an international presence. The primary function of a global PEO is to act as an employer of record (EOR) for the client’s employees in various countries. This allows companies to expand their operations globally without establishing a legal entity in each country they hire in.