As a business owner, it’s crucial to have clear direction and organization to stay on top of your finances. Without it, you risk losing track of your expenses, leading to unnecessary costs and falling short of your profit goals.

That’s why it’s vital that you take proactive steps toward implementing budgeting methods to ensure that your bottom line stays on target.

The good news is that there are plenty of reliable budget templates out there that can help guide you through the entire process.

Having a well-crafted budget template can help you accurately track your actual expenses and business income, so you know how money is being spent and how to plan for the future.

In a hurry? Take a look at some of our favorite Business Budget Templates:

| Business Expenses | 🚀 Take steps towards improving cash flow | Expenses |

| Business Case | 💯 Track progress & success | Business Case |

| Business Budget | 💰 Achieve financial success. | Business Budget |

| Cost-Benefit Analysis | 🎯 Ensure optimal performance over time | Cost-Benefit |

| Marketing Budget | ✅ Boost efficiency & maximize the use of financial resources | Marketing Budget |

A business budget template should include all of your revenue sources, such as sales or investments, as well as all of your projected expenses, like overhead costs, taxes, and salaries. You’ll also want to account for any unexpected costs that could arise during the year.

In this blog post, we’ll provide an overview of some of the best business budget templates available so you can choose one that fits your company’s needs and helps maintain financial health and stability. These templates are designed specifically with businesses in mind. They are easy to use, and customizable, so you can modify them to meet the needs of your business.

Let’s get started!

Page Contents (Click To Jump)

What Is a Business Budget Template?

A business budget template is an essential tool that empowers you to effectively manage your finances both in the short and long term. It helps to effortlessly track all your expected revenue, monthly expenses, and savings goals. By doing so, you gain valuable insights into the financial performance of your company each month, allowing you to gauge its success.

What makes a good budget template even more remarkable is its flexibility, enabling you to customize it according to your unique business requirements. By utilizing a budget template, you seize control of your finances, ensuring that you allocate resources optimally to meet your goals.

With the right budget spreadsheet, whether it’s a small business budget template or a startup budget template, you’ll effortlessly stay on top of your finances and pave the way for long-term success in your business.

Best Business Budget Templates for Enterprises

1 High-Level Marketing Budget

🥇 Why this is a good business budget template: By providing valuable insights into projected marketing expenses within your industry, this template facilitates efficient resource planning and allocation. This enhances efficiency and maximizes the utilization of financial resources, ensuring optimal results.

2 Cost-Benefit Analysis Template

The Cost-Benefit Analysis Template is a great tool for businesses looking to quickly identify the potential economic impact of any proposed project. It allows for easy comparison of expected costs and benefits, enabling you to determine whether or not the venture should be pursued.

🥇 Why this is a good business budget template: By offering a thorough analysis of costs versus benefits, this template empowers entrepreneurs to make well-informed choices regarding which opportunities to seize and which to steer clear of. Additionally, managers will be able to effectively monitor ongoing investments and projects, ensuring optimal performance over time.

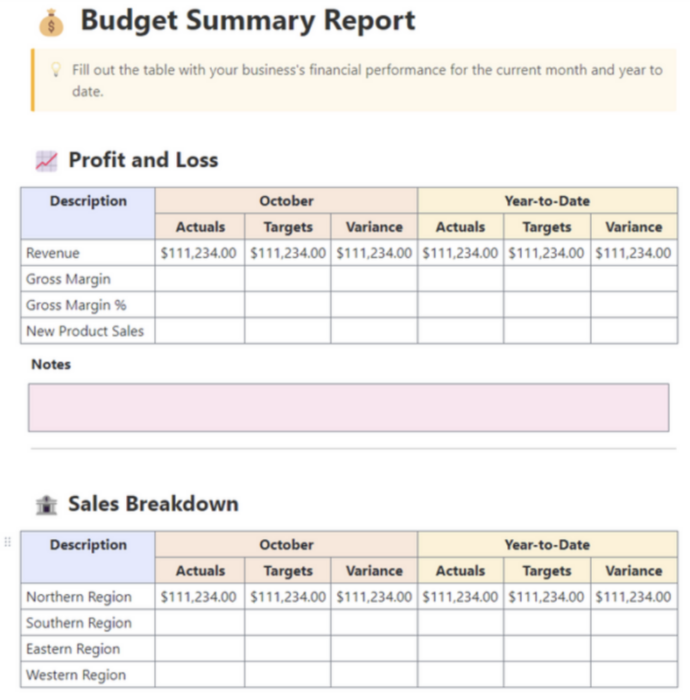

3 Budget Report Template

The Budget Report Template is an excellent way to track and monitor your business’s financial performance. It provides an easy way to examine the impact of expenditures on your net or actual income and determine whether or not your goals are being met.

🥇 Why this is a good business budget template: Business owners who use this template can swiftly pinpoint potential cost-saving areas and evaluate the return on investments. Additionally, it facilitates effortless comparisons between the current budget and past performances so that business owners make necessary adjustments seamlessly.

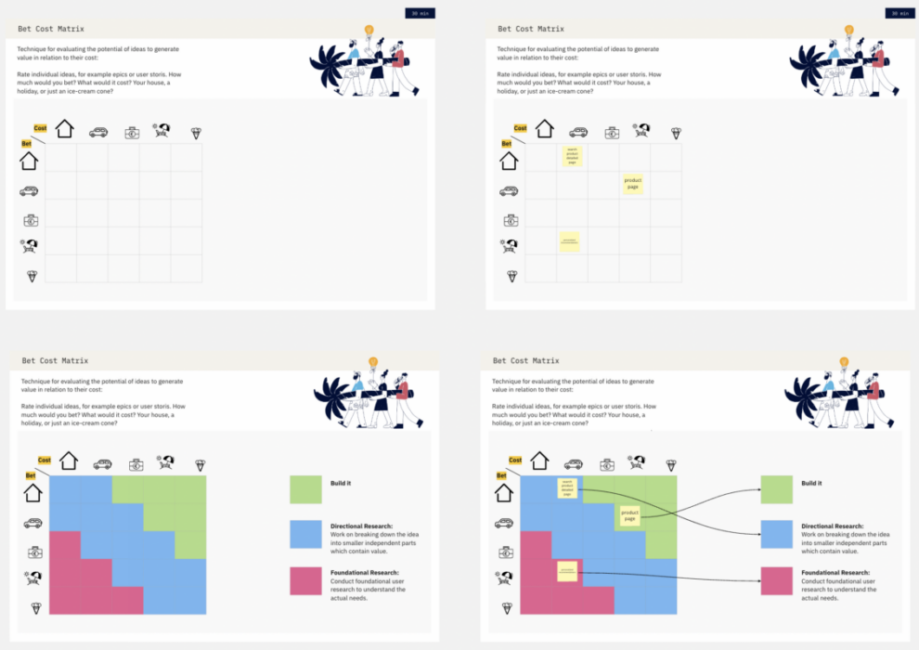

4 Bet Cost Matrix

The Bet Cost Matrix is ideal for comparing the cost of different options in order to make the most economical and financial decision. It allows you to quickly analyze and review various scenarios in order to choose the one with the highest potential return on investment. The fields are typically combined into clusters, each with an assigned action to ensure the idea is production-ready.

🥇 Why this is a good business budget template: This template offers a thorough analysis of the cost and benefit factors linked to a variety of potential decisions. It empowers business owners to make accurate comparisons among different alternatives, enabling them to select the option that provides the greatest value for their investment.

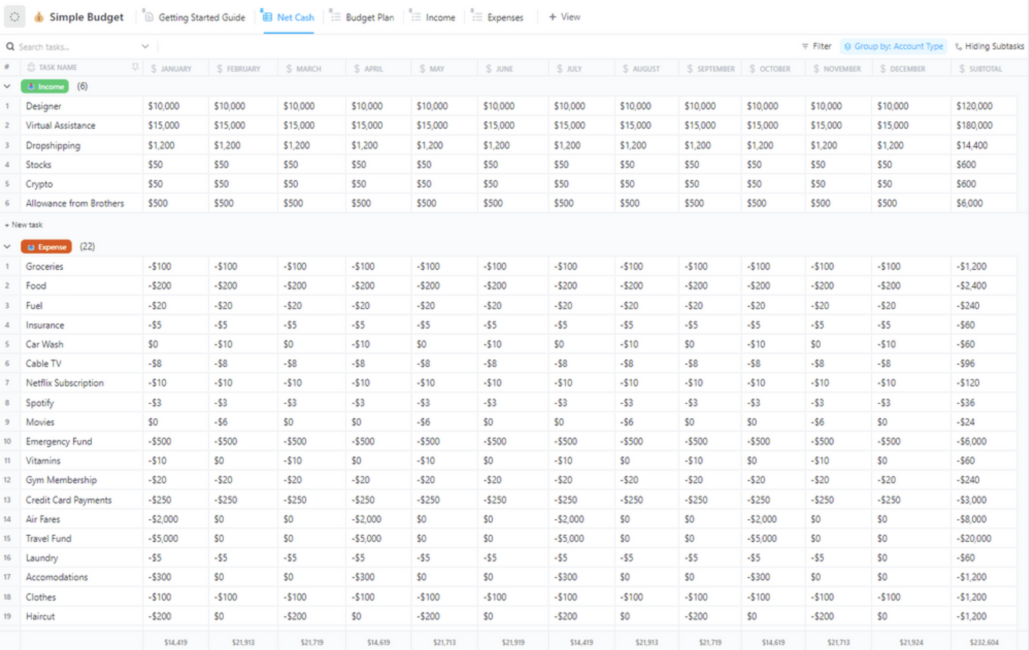

5 Simple Budget Template

The Simple Budget Template is specifically designed for small businesses or new businesses that are in the early stages of development and require a comprehensive yet uncomplicated framework to establish their financial plan. With its intuitive interface, this budget template offers a seamless and efficient solution for recording income, variable costs or startup costs, and other crucial data points, enabling you to evaluate and analyze your current financial situation with precision and ease.

🥇 Why this is a good business budget template: This user-friendly budget template provides users with a clear overview of their financial standing and the potential changes that can be made to increase profitability. It allows for easy input of data, allowing quick and effective decision-making processes.

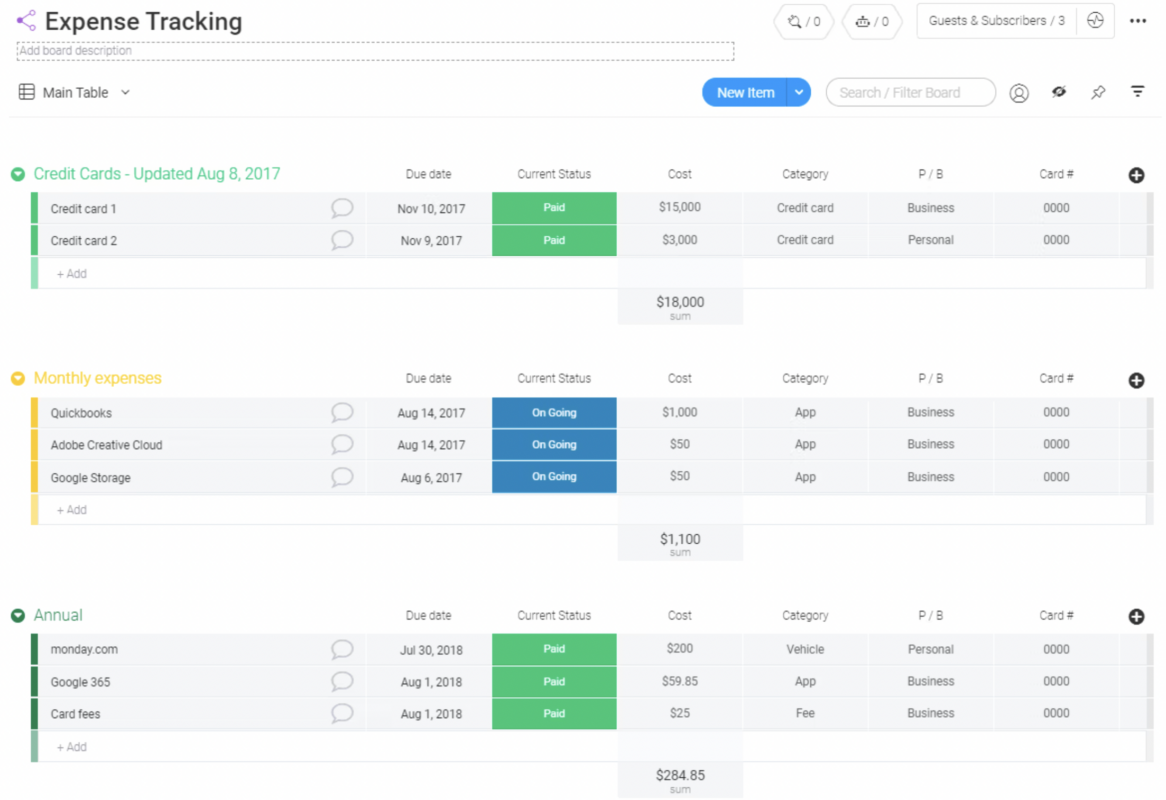

6 Business Expenses Template

The Business Expenses Template is a great option for companies looking to track and manage their operating expenses and overhead costs. It provides detailed categorization, allowing for easy tracking of expenditures in each area of your business. Additionally, it includes features that allow you to view historical budgets and compare current budget data with past performance.

🥇 Why this is a good business budget template: This template is an excellent resource for businesses that need to find ways to reduce their expenses. Providing an in-depth overview of all your costs makes it easy for business owners and managers to identify areas of potential savings and take steps towards improving cash flow.

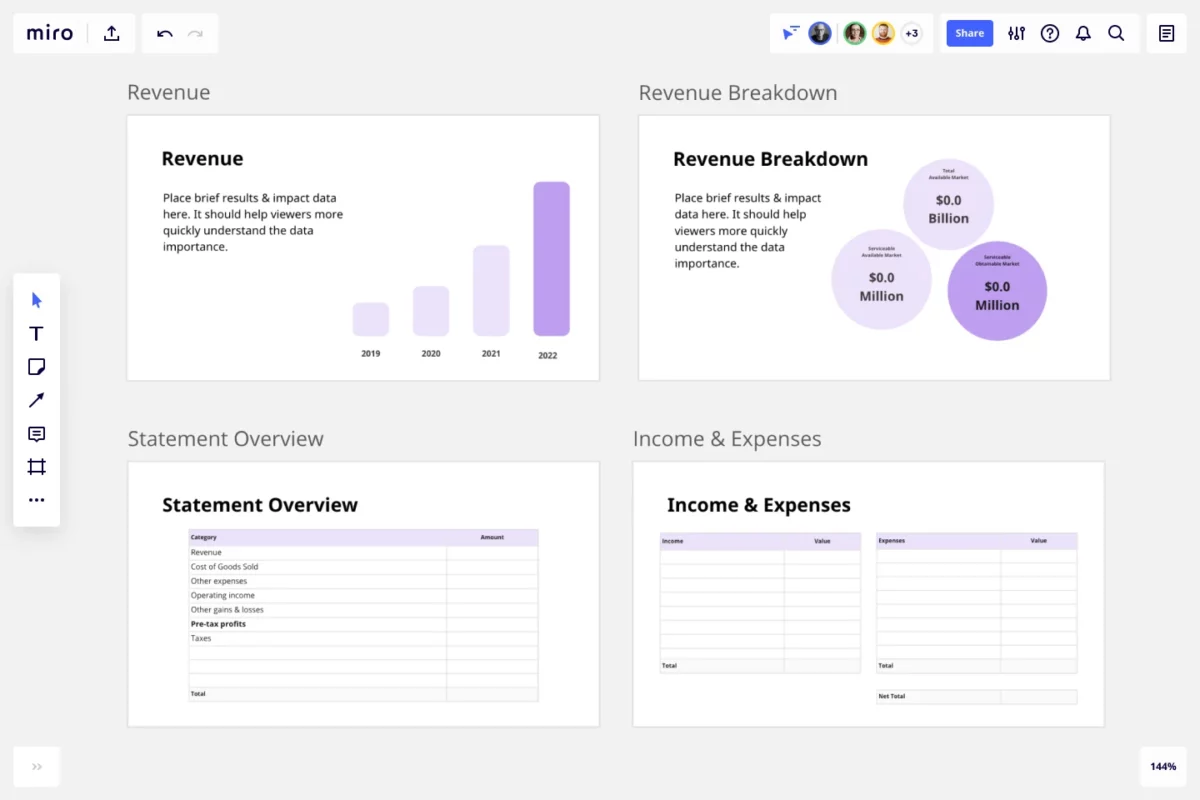

7 Financial Presentation Template

The Financial Presentation Template is suitable for businesses that need to explain their budget and financial plans to stakeholders. It provides a professional platform for sharing data in a visually appealing manner, enabling users to illustrate key points with charts and graphs. Additionally, it allows you to provide qualitative analysis of the data.

🥇 Why this is a good business budget template: This template features visually compelling graphics that emphasize key budget details. Its comprehensive data analysis facilitates stakeholders to better grasp crucial investment decisions, companies to conduct monthly, seasonal, and annual financial presentations, and gain a deeper understanding of their financial well-being.

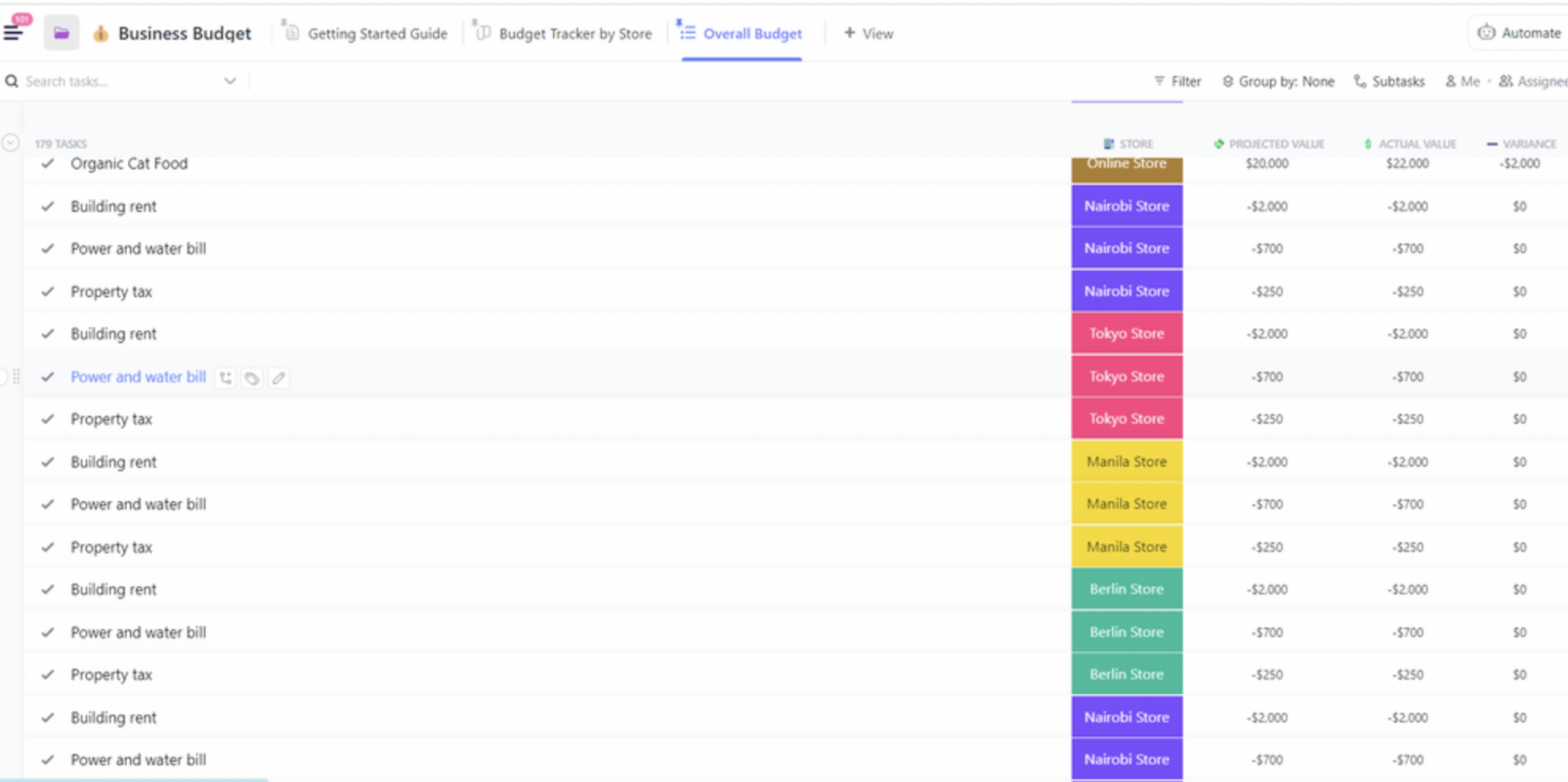

8 Business Budget Template

The Business Budget Template is a vital asset for companies seeking to maintain financial discipline and effectively manage their finances. It provides a breakdown of financial figures, facilitating easy tracking of income and expenses across various aspects of the business. With its user-friendly interface and powerful features, this template is a valuable tool for achieving financial success.

🥇 Why this is a good business budget template: This template helps businesses stay on track and make the most out of their resources. Its detailed categorization allows users to track their spending and identify areas where cost-cutting measures can be implemented. It also enables them to stay aware of new opportunities that may arise when they have extra funds available.

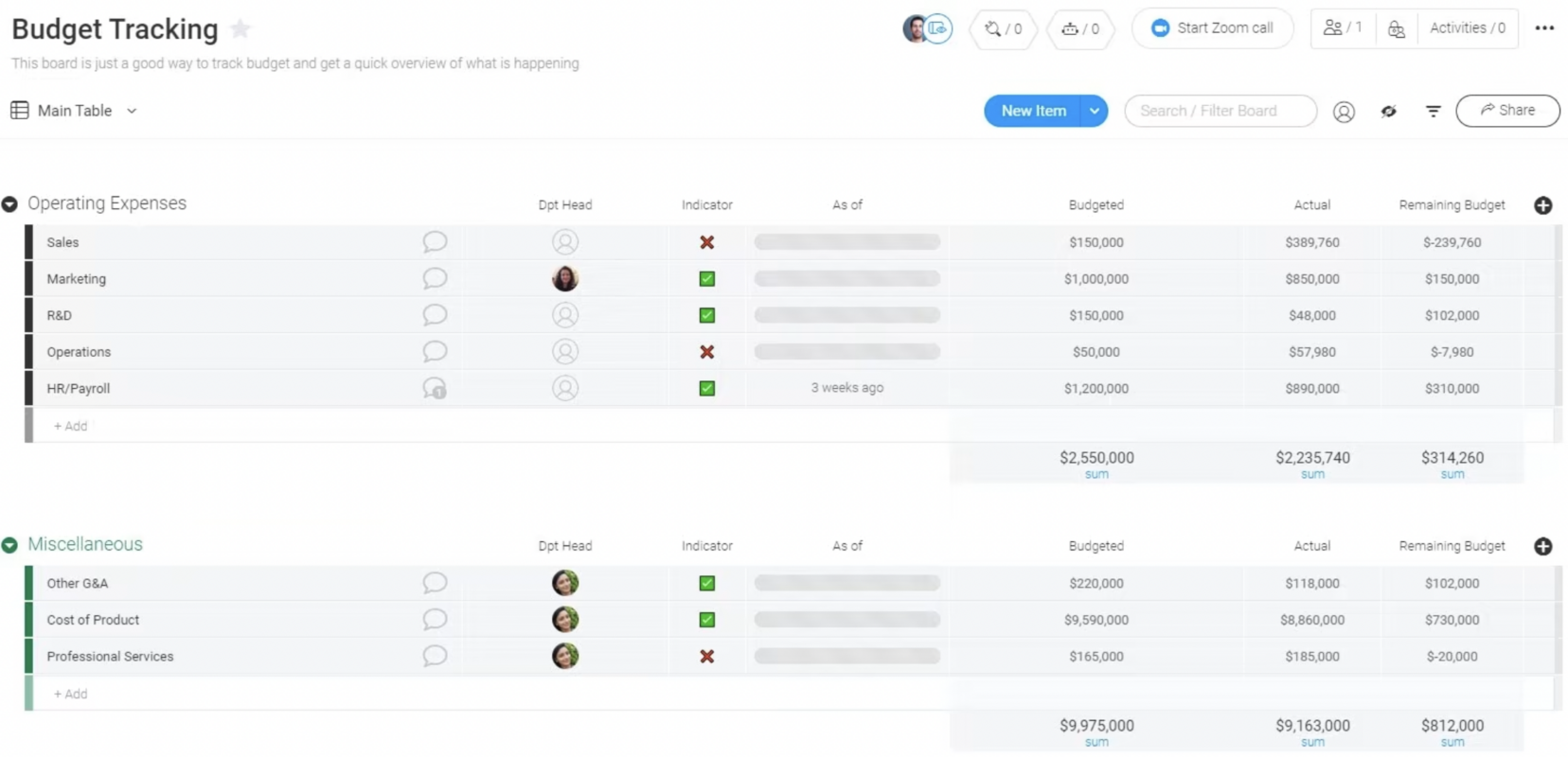

9 Budget Tracking Template

The Budget Tracking Template is an invaluable resource for businesses aiming to stay informed about their operating costs and closely monitor their overall spending. With its comprehensive categorization, users can seamlessly analyze and compare expenses across different categories.

🥇 Why this is a good business budget template: This template features multiple columns and rows that meticulously track every aspect of your spending. These columns include the date, vendor, expense description, amount, unit cost, method of payment, and even formulas for automatic expense calculations. By using these spreadsheets, you gain a clear understanding of how you and your team allocate and spend money, stay in control of your budget, and achieve your financial goals with ease.

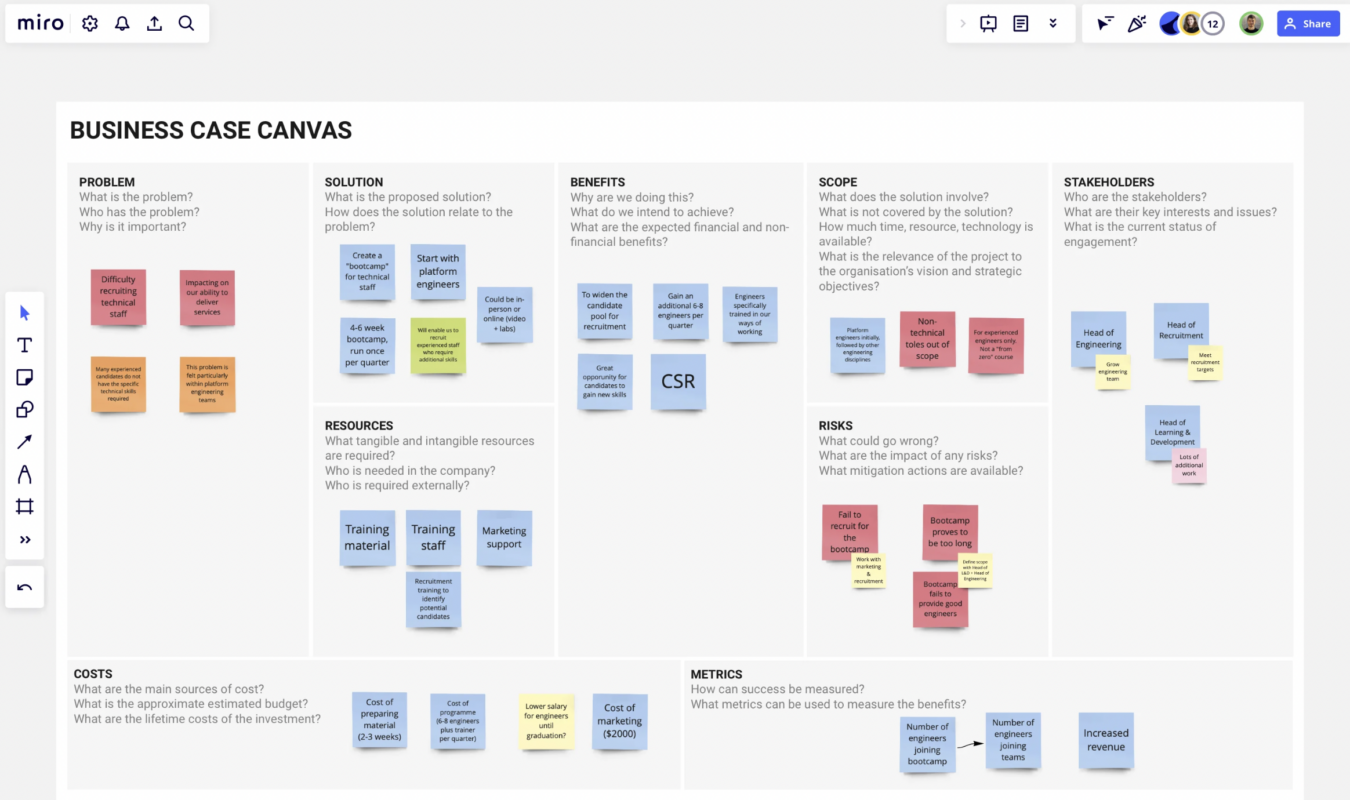

10 Business Case Template

The Business Case Template effectively highlights the core business problem and offers comprehensive strategies for its resolution. It goes beyond that to provide a detailed roadmap for implementing your business plan, covering nine crucial aspects. These include clearly defining the problem, outlining a compelling solution, showcasing the anticipated benefits, specifying the scope of the project, identifying key stakeholders, determining necessary resources, assessing potential risks, estimating costs, and establishing measurable metrics to track progress and success.

🥇 Why this is a good business budget template: By addressing each of these key areas, this template ensures a thorough and well-rounded approach to tackling your business challenges and achieving your goals. This template empowers users to effectively execute their plans and stay on track with their budgeting goals, thanks to its comprehensive roadmap.

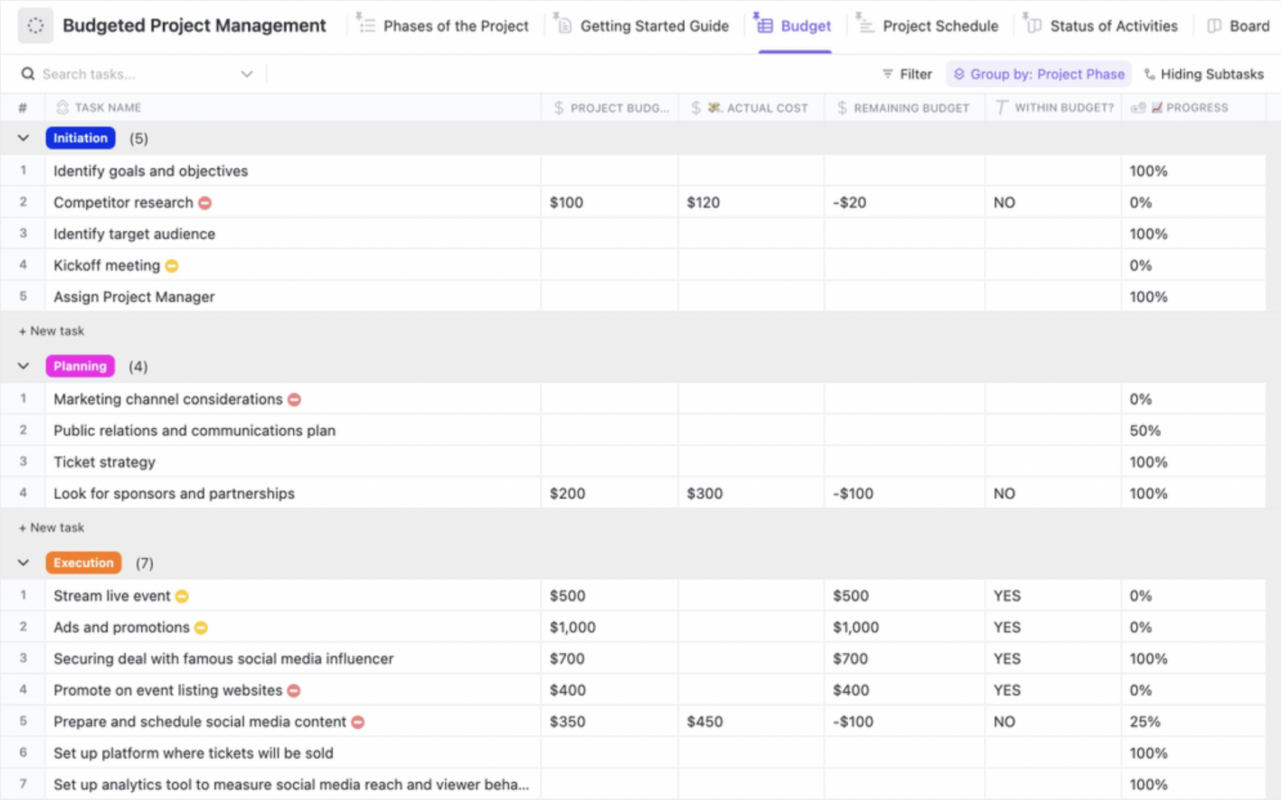

11 Budgeted Project Management

The Budgeted Project Management helps businesses identify and manage potential risks while staying on track with their budgets. It allows users to accurately estimate costs, build robust budget plans, and monitor performance against pre-set goals. Its easy-to-follow features help users keep their projects on schedule and ensure that they achieve maximum efficiency and success with their allocated resources.

🥇 Why this is a good business budget template: Users are able to accurately monitor their budgeting goals and progress and adjust their plans when needed, setting in motion a process of continued optimization. By taking a proactive approach to managing projects, users maximize the use of their resources and ensure that they remain on track with their business objectives.

12 Expense Tracker Template

The Expense Tracker Template provides detailed information about the “what,” “why,” “who,” and “how” of spending company funds. For instance, it specifies the purpose of the expense, the reason behind it, the person responsible for making the purchase, and the amount spent. This comprehensive tool ensures accurate and organized financial management for businesses.

🥇 Why this is a good business budget template: This template is a game-changer for businesses, offering comprehensive categorization that enables effective expense management and diligent budget monitoring. With its help, you can easily identify non-essential expenditures and make necessary adjustments to stay within your allocated funds. By utilizing this powerful tool, you’ll ensure your business remains organized, well-maintained, and set up for success.

Benefits of Using Business Budget Templates

❇️ Benefit 1: Organization 📑

Developing a well-crafted business budget template is crucial for maintaining financial organization and achieving short-term goals. By utilizing a budget template, businesses can effectively plan their expenses in advance and monitor their progress over a period of time.

❇️ Benefit 2: Staying on track 🎯

Using a business budget worksheet helps companies stay on track with their financial goals, identify areas of improvement, and make necessary adjustments quickly and efficiently. This ensures that businesses continue to remain in control of their finances and are able to execute their strategies successfully.

❇️ Benefit 3: Flexibility ✅

Business budget templates offer users the flexibility to adjust their budgets as needed. This makes it easy for them to plan and manage their finances in accordance with changes that occur over time. By having a budget template in place, businesses can anticipate any potential financial difficulties and make accommodations accordingly. Budget templates are comprehensive and adaptable, catering to your specific needs. They offer detailed categories and subcategories for easy expense tracking across all areas of your business, whether it’s a small business or a large one.

❇️ Benefit 4: Reference data 📊

These templates also include features that allow you to easily input data, view historical budgets, and compare your current budget to past performance.

❇️ Benefit 5: Time-saving ⏰

Budget templates have built-in formulas so you can quickly calculate the values of your budget items. With a reliable template at your disposal, you’ll be able to create an effective business budget in no time.

Mistakes To Avoid When Using Business Budget Templates

❗️Not Customizing the Template

Every business is unique, and a one-size-fits-all budget template may not suit your specific needs. It’s essential to tailor the template to your business by adding or removing line items that are or are not relevant to your operations.

❗️Overlooking Hidden Costs

It’s easy to remember the large, obvious expenses but harder to recall the small or less frequent ones. Be sure to account for all potential costs, including fees, subscriptions, and maintenance costs that might not be included in a generic template.

❗️Failing to Update Regularly

A budget should be a living document. As your business grows and changes, so should your budget. Don’t make the mistake of setting your budget once and never revisiting it.

❗️Over-Optimism in Revenue Projections

It’s common for business owners to overestimate future revenues. Be realistic in your projections to avoid shortfalls that could lead to cash flow problems.

❗️Ignoring Historical Data

Past financial statements are vital in forecasting future budgets. Not using historical data to inform your projections is a missed opportunity for accuracy.

❗️Forgetting to Plan for Contingencies

It’s crucial to set aside a portion of the budget for unexpected expenses. Failing to do so can leave you unprepared for emergencies.

❗️Lack of Collaboration

If more than one person is responsible for the finances or operations, failing to collaborate on the budget can lead to discrepancies and oversights.

❗️Underestimating the Importance of Cash Flow

Profitability isn’t the only financial concern; cash flow is equally important. Ensure your budget template includes a cash flow forecast.

❗️Neglecting to Set Clear Goals

A budget should reflect the strategic goals of your business. Without clear goals, your budget may not effectively support your business’s growth and direction.

❗️Using Overly Complex Templates

If your template is too complicated, it might become time-consuming to maintain, which can lead to mistakes or neglect. Use a template that is complex enough to capture all necessary information but simple enough to use regularly.

❗️Incorrect Formatting or Formulas

Spreadsheet errors can occur if formulas are not set up correctly. Double-check all calculations and consider using built-in spreadsheet functions to minimize errors.

❗️Not Reviewing Regularly for Accuracy

Regularly compare your budgeted figures to your actual income and expenditure. This can help you catch errors and make necessary adjustments.

❗️Insufficient Detail

While too much complexity can be an issue, too little detail can also be problematic. Ensure your budget breaks down costs and revenues sufficiently to provide meaningful insights.

❗️Not Incorporating Feedback

If your budget has been reviewed by others (like a financial advisor), failing to incorporate their feedback can result in missed opportunities for improvement.

❗️Neglecting to Factor in Seasonality

Many businesses have seasonal fluctuations in revenue and expenses. If this applies to your business, your budget should account for these variations.

People Also Ask Questions About Business Budget Templates

Q: How do I choose the right business budget template for my team?

- A: The right business budget template for you depends on the size, scope, and complexity of your project. Smaller projects may require a simpler template with fewer details, while larger projects may require an advanced template that allows for more customization. Consider your team’s needs as well as the features offered by the template before making a selection.

Q: Can I modify existing business budget templates or do I need to create my own?

- A: You can certainly modify existing business budget templates to suit your specific needs. Many of these templates offer extensive customization options, allowing you to adjust various features such as columns and rows, calculation formulas, and even aesthetics. When in doubt, it’s always best to consult with a professional financial advisor or accountant before making any changes.

Q: What are some common business budget templates?

- A: When creating a business budget, the type of template that you choose should depend on your industry and the size of your business. For example, some common templates include an annual budget with monthly or quarterly updates; a weekly or monthly budget; and a detailed multi-year plan for larger businesses. It is important to have a clear understanding of how much money is coming in and out of your business so you can adjust your budget accordingly.

Q: What are some common mistakes to avoid when using a business budget template?

- A: When using a budget template, it is important to make sure that all of the figures are accurate and up-to-date. It’s also important to ensure that you consider every potential expense which could have an impact on your budget. Finally, be sure to review your plan regularly to stay ahead of any unexpected changes or financial obstacles. Taking these proactive steps will help ensure that your business remains on track and within budget.